- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Financial market analysis: Oil outlook

In September 2024, global crude oil prices fell to their lowest levels since August 2021 after OPEC revised its oil demand forecast for 2024 downwards for the second consecutive month. Brent crude dropped below $70 per barrel. OPEC now expects demand to grow by 2.03 million barrels per day (bpd), down from the previous forecast of 2.11 million bpd. This adjustment mainly reflects a reduced demand outlook from China, the world’s largest oil importer, which is facing economic challenges, including a weak property market and a shift towards cleaner energy alternatives. Additionally, the growing use of alternative fuels and China’s expanded high-speed rail network are reducing demand for traditional oil-based transportation fuels.

Oil prices have since rebounded from those lows, mainly due to global supply concerns as Hurricane Francine caused partial disruptions to energy production in the US Gulf of Mexico and due to delays in resolving Libya’s political dispute. Despite the rebound in crude prices, the broader picture shows that the bearish bias in crude oil spot prices remains entrenched. The oil market is being pressured by China’s slow economic recovery, a potential global supply glut, and growing non-OPEC oil production, particularly from the United States, Guyana, Canada, and Brazil. The International Energy Agency (IEA) warns that the global oil market could be oversupplied in 2025 if OPEC+ unwinds its current production cuts.

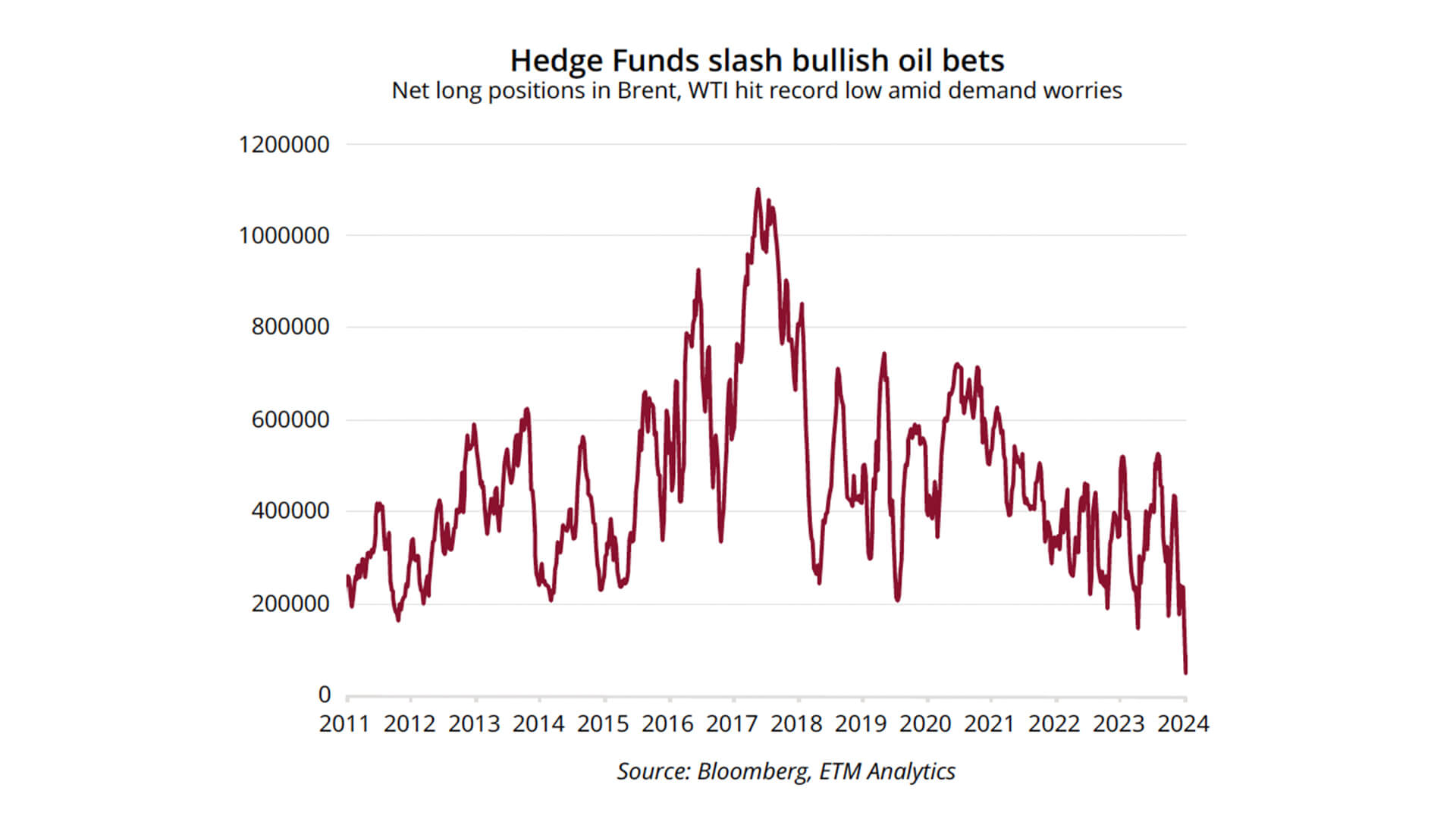

OPEC+ is grappling with how to balance the market in the face of these challenges. While supply disruptions in Libya and the US have provided temporary price support, the overall outlook remains pessimistic. Hedge funds and other financial speculators are also reducing their net long positions in oil, signalling a bearish sentiment in the futures market.

The bearish oil outlook has significant implications for African oil producers. Angola and Nigeria, heavily reliant on oil revenues, face risks to government budgets, foreign currency reserves, and economic stability. Angola depends on oil for 28.9% of its GDP and 95% of its exports. Angola's currency has depreciated over 11% year-to-date, worsening inflation and liquidity issues. Nigeria, Africa’s top oil producer, with oil exports accounting for 75% of total exports and approximately 90% of its foreign exchange earnings, also faces reduced revenues, which could impact public services and infrastructure projects. However, Nigeria's recently launched Dangote refinery may ease some pressures by reducing fuel imports and foreign exchange demand.

However, the decline in crude oil prices could provide some relief for African oil-importing nations. Lower oil prices will reduce their import bills, saving foreign currency reserves and helping to ease inflationary pressures.

Overall, according to ETM research, oil prices are currently undervalued and relatively cheap at a time when the global business cycle is turning, which means oil consumption will likely slow further, exerting downward pressure on oil prices. Slower global growth, particularly in China and the US, is expected to weaken demand. Rising non-OPEC oil production and the potential for a global supply glut in 2025 pose additional challenges. While geopolitical developments, such as Middle East tensions and weather-related disruptions, may provide short-term price support, the broader outlook for crude oil remains bearish in the near term.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partner, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.