- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Keeping the Naira Steady: CBN’s Policy Challenge

The Central Bank of Nigeria (CBN) has maintained the Monetary Policy Rate (MPR) at 27.5% since January 2025, following cumulative hikes of 1600 bps between 2022–2024, including a sharp 400 bps move in February 2024. Inflation has likely peaked but remains elevated at 21.9% in July, aided by improved agricultural supply, softer global commodities, and a more stable naira (+0.6% YTD vs USD). However, core inflation (21.3% y/y) underscores persistent price pressures. Attention has shifted to the likely timing of rate cuts in Nigeria. However, with inflation still well above the CBN’s long-term target of 6–9%, meaningful rate cuts in 2025 appear unlikely. Furthermore, while harvest season disinflation could allow the CBN to start preparing the ground for easing, Governor Olayemi Cardoso has reaffirmed a tight stance until inflation risks recede significantly. Overall, we see scope for a small cut of 50–75 bps in late 2025 at the earliest, contingent on stable FX reserves, a resilient naira, and supportive global conditions. Broader easing is more plausible in 2026 if inflation falls closer to single digits.

Global spillovers and FED policy

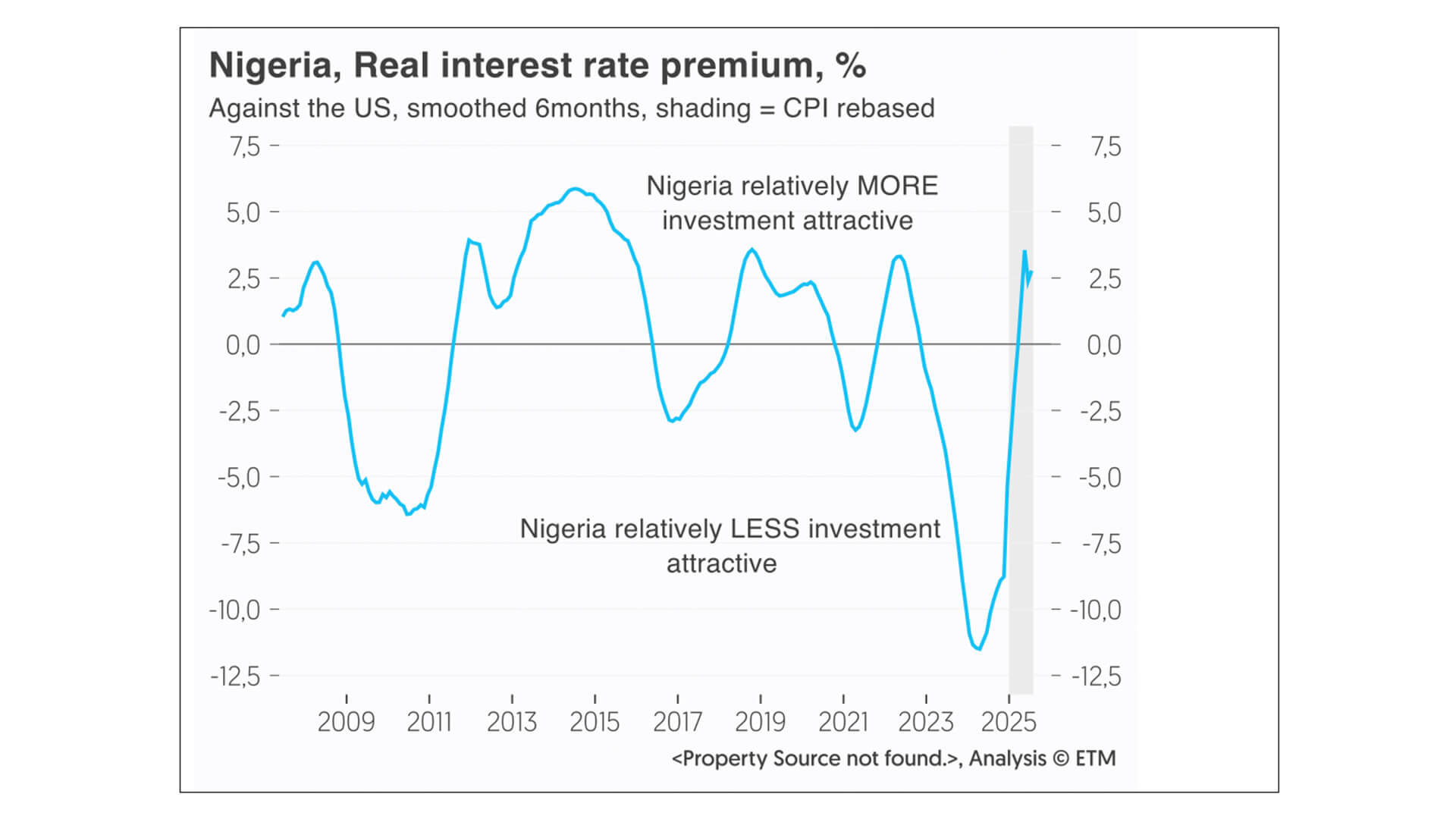

Nigeria’s rate path will be heavily influenced by the global backdrop, particularly US monetary policy. Markets expect two 25 bps Fed cuts by the end of the year, which, if realised, would ease pressure on the CBN to sustain ultra-high yields. For now, Nigeria maintains a real yield premium versus the US, supporting naira assets and helping anchor FX stability. The CBN is intent on fixing the currency system and maintaining relatively high rates to attract capital to support the naira amid ongoing FX system reforms, which supports the view that the CBN will likely proceed with caution regarding interest rate cuts.

Portfolio inflows: strong but fragile

Tight policy has fuelled record foreign portfolio inflows (FPI). In Q1 2025, Nigeria attracted $5.2bn in FPI (93% of total capital importation), up 67% y/y. The banking ($3.1bn) and financing ($2.1bn) sectors dominated, with flows concentrated in OMO bills and T-bills. This underscores Nigeria’s appeal to yield-hungry investors but also the dominance of short-term “hot money” leaving inflows highly sensitive to shocks.

FPI outlook: cautiously optimistic

The outlook for H2 2025 suggests $11–13bn in inflows, supporting a projected $19.3bn full-year total (+56% y/y), provided reforms stay on track. Key risks include:

- Oil prices: Downside supply risks could weaken FX buffers.

- Currency stability: Naira appreciation YTD is fragile; volatility remains a threat.

- Global risk sentiment: Escalating trade tensions or delayed Fed easing could spur outflows.

- Structural challenges: Regulatory uncertainty, infrastructure deficits, and concentration of inflows in Lagos/Abuja remain hurdles.

Nigeria’s tight monetary stance has reinforced FX stability and attracted record inflows, but sustainability hinges on reform credibility, global monetary conditions, and oil price dynamics. We expect the CBN to maintain its hawkish bias through most of 2025, with only limited easing possible late in the year. The balance of risks remains skewed toward caution, with portfolio flows likely to stay strong yet vulnerable to shocks.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partners, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.