- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Africa and the global minerals race, China’s rare earth controls reshape the strategic landscape

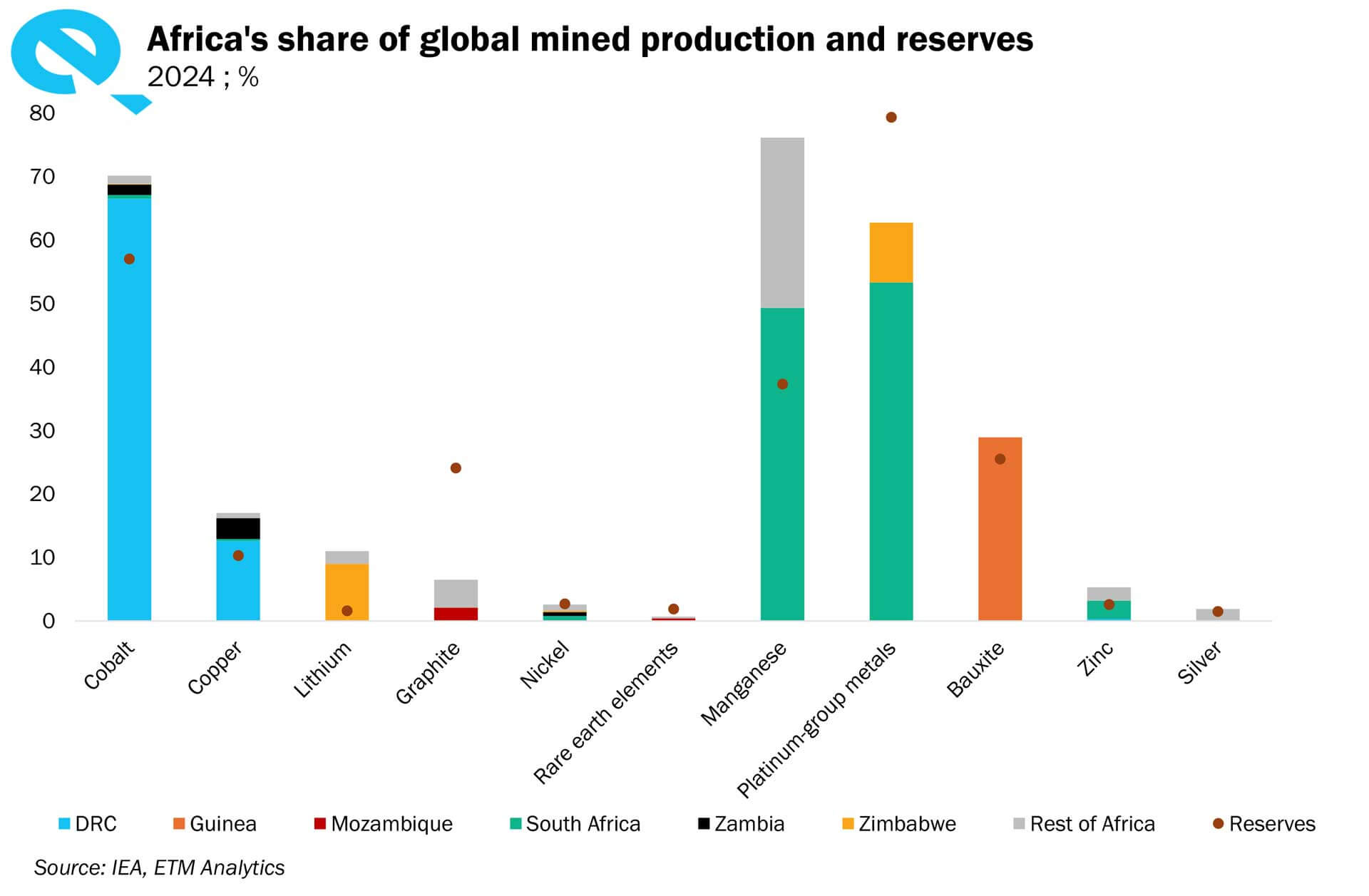

China’s dominance over the global rare earth supply chain stems from decades of planning, controlling about 70% of global mining and over 90% of processing and magnet production. Some analysts view the export curbs as a show of strength, while others interpret them as a sign of economic strain. The restrictions have spurred countries to diversify. India is exploring ferrite-based magnets, Taiwan is expanding domestic recycling, and Australia’s critical mineral producers have surged on expectations of increased demand. The US has partnered with Australia to strengthen rare earth supplies and previously helped mediate peace between the Democratic Republic of the Congo and Rwanda to stabilise access to key minerals like cobalt—part of a broader effort to reduce dependency on China. However, establishing new refining and processing capacity will take time, leaving global industries exposed in the short term.

China’s export curbs may ultimately accelerate diversification, driving investment in refining and manufacturing outside its borders. For African nations, this represents a defining opportunity to capture more value from their resources, strengthen economies, and increase global influence. By building local processing, smelting, and component industries, Africa can transition from being a supplier of raw materials to a key player in the global clean energy and technology economy while also improving social inclusion and equitable development across the continent.

In collaboration with MCB Strategy, Research and Development Team and ETM Group.

For more information, please contact MCB Global Markets Team on [email protected]

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.