- Home

- Investor Centre

- Sustainability

- Talent

- News

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- MCB Offices

Contact Info

Financial Market Analysis: A week is a long time in politics

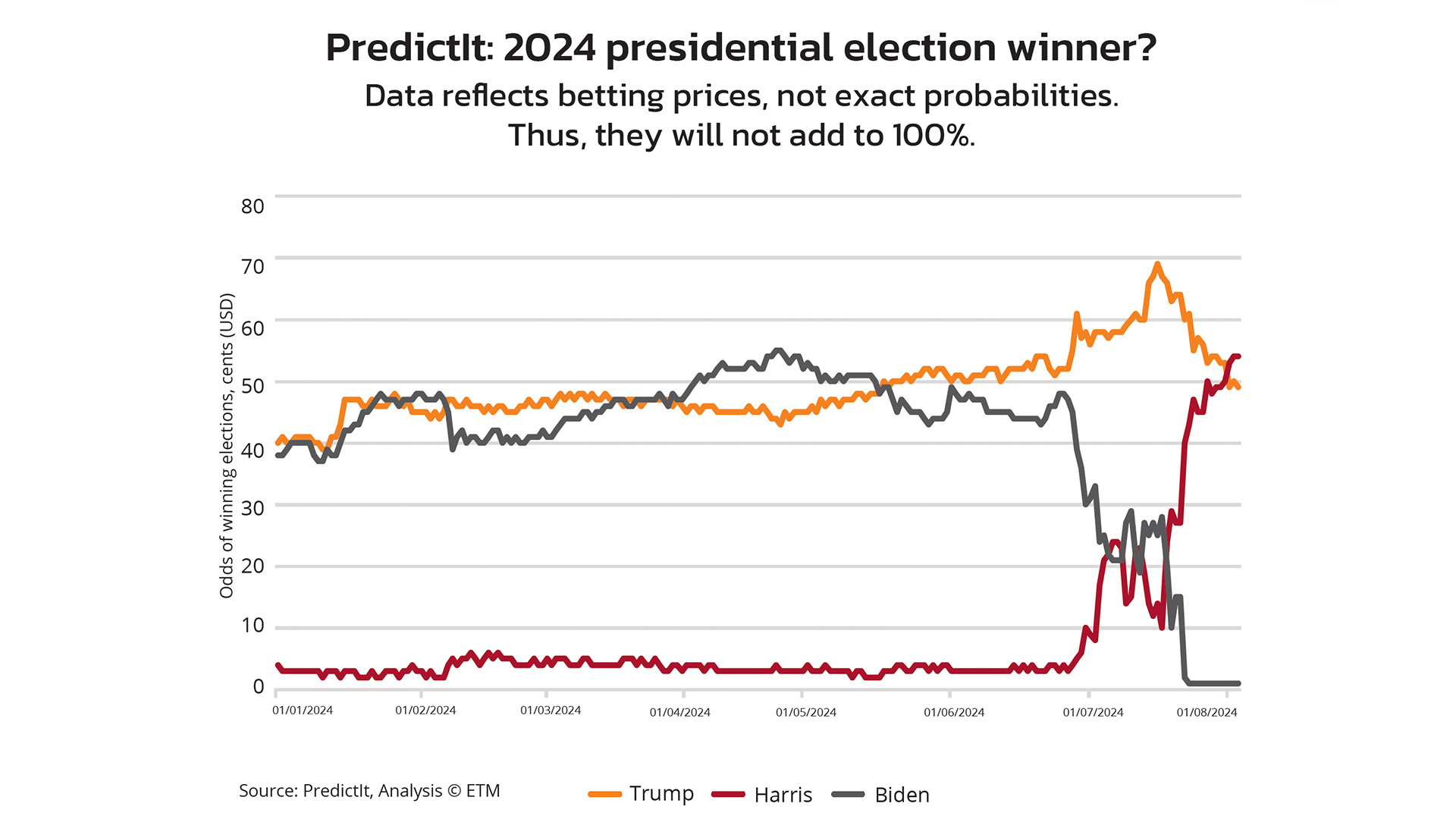

As the saying goes, “a week is a long time in politics”. Biden has pulled out of the 2024 presidential race but announced that he would finish his current term as the U.S. president. Reports suggest that democratic party donors threatened to withhold funds unless Biden stepped down. President Biden threw his support behind Vice President Kamala Harris who appears to have garnered enough support to become the Democratic Party’s nominee for president

Polling data shows that Harris is closing the gap on Trump, whose support has dropped following his attempted assassination, which saw his support rising to an all-time high.

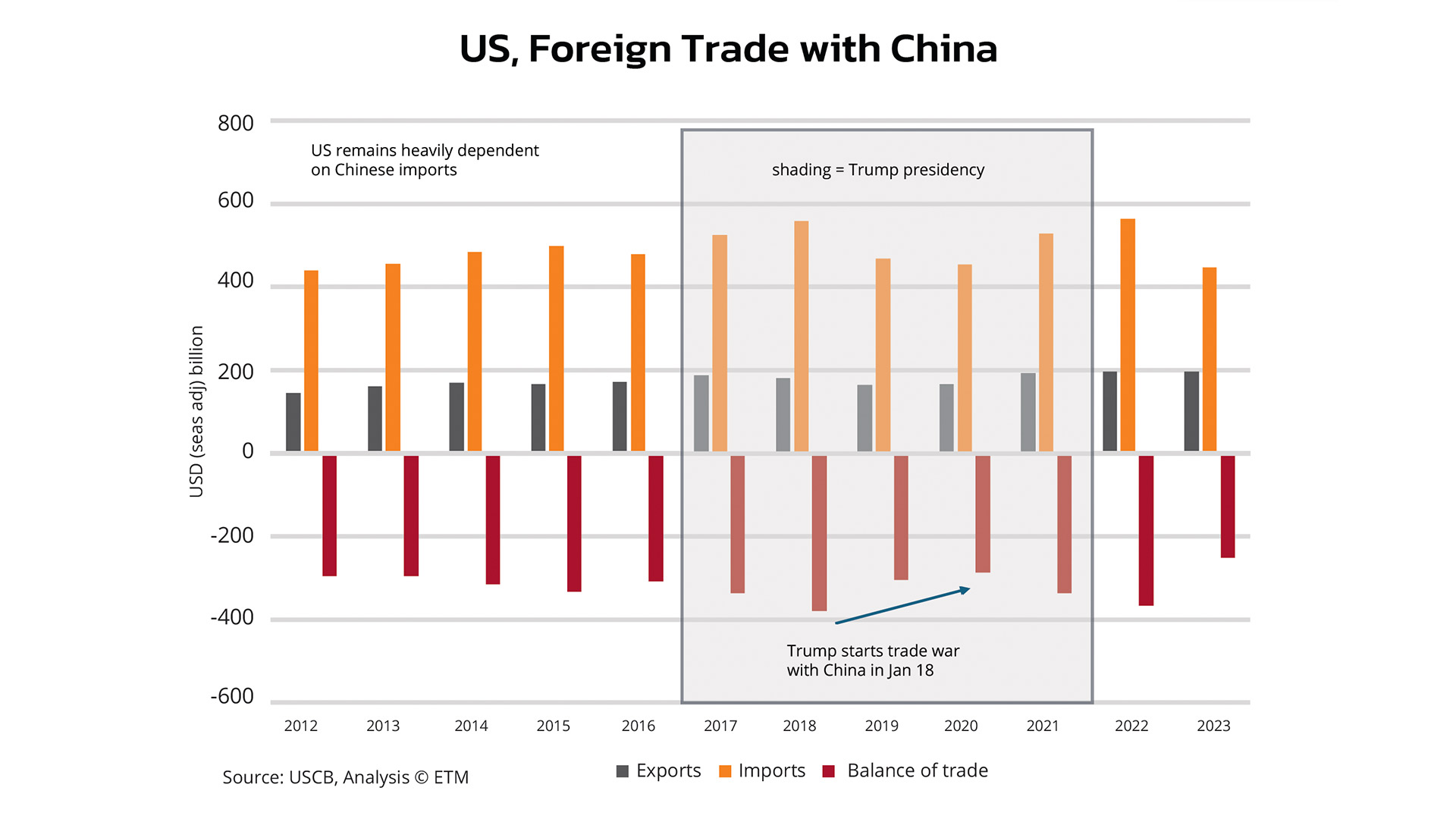

A Trump presidency would likely see increased protectionism. Trump has indicated that he would impose a 60% tariff on all Chinese goods and a tariff of at least 10% on $3 trillion worth of US imports should he get a second term. As can be seen from the chart below, Trump’s presidency and the imposition of increased tariffs on imports from China in 2018 had only a marginal effect on narrowing the US trade deficit with China because the US remains heavily dependent on Chinese imports. There would be a significant cost for US consumers, estimated at least $500 billion a year or 1.8% of GDP in research by the Peterson Institute for International Economics. This represents a clear inflationary impact that would detract from economic dynamism. This does not include the damage from retaliation from other countries, slower economic growth, and a loss of competitiveness

Any slowdown in Chinese exports to the US would have a significant effect on China because the US is one of China’s largest trading partners. Exports are a particularly bright spot for China, with domestic issues abounding. Given China’s role in the global economy, a slowdown in growth in China will be felt worldwide.

Nevertheless, it is worth pointing out that a Harris administration will likely follow Biden’s economic blueprint on trade, taxes and immigration even though she tended to lean more progressive on some issues in the past. She would likely continue tariffs and some interference in Chinese internal affairs. Therefore, US-China relations would likely remain strained under a Harris presidency.

Ultimately, with three months to go till the US election, uncertainty prevails as these elections have the potential for significant shifts in economic policy with repercussions for the global economy.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partner, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.