- Home

- Investor Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

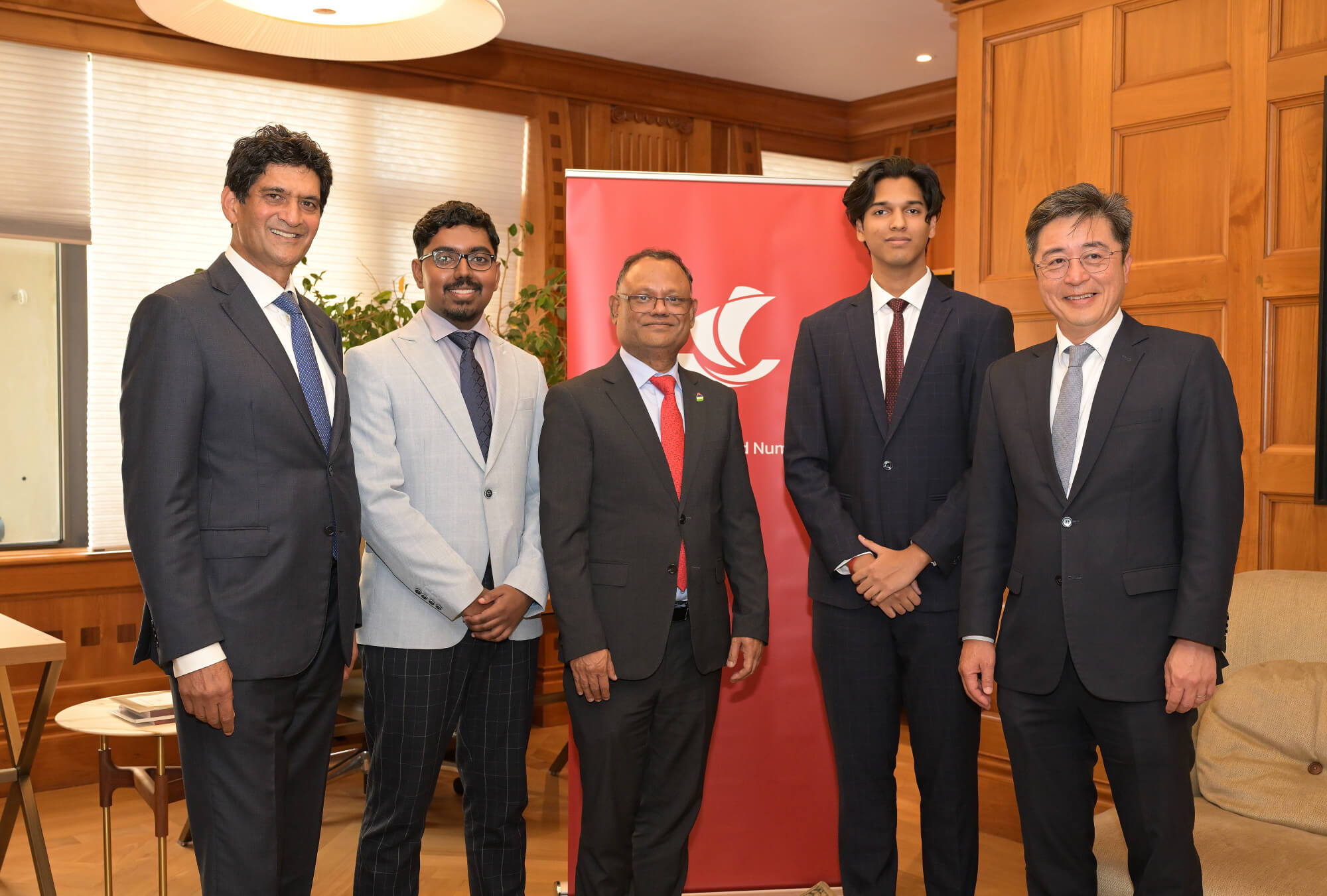

MCB Capital Markets partnered with CIEL Limited to launch its Sustainable Finance Framework

MCB Capital Markets was mandated by CIEL Limited to develop and launch the investment group’s first Sustainable Finance Framework, a move that represents a notable evolution in Mauritius’ financial landscape. This makes CIEL the first major Mauritian investment group to formally integrate environmental, social and governance (ESG) considerations across its financing decisions.

This collaboration, supported by MCB’s Central Sustainability Office, reflects broader momentum in the region to align capital flows and governance practices with sustainability goals. It also signals MCB Group’s growing role as a regional leader in advising institutions as they transition toward low-carbon, socially inclusive and climate-resilient business models.

Aligning finance with ESG goals

Spanning sectors such as textile, hospitality, finance, healthcare, property and agriculture, CIEL’s footprint extends across more than ten countries. Its Sustainable Finance Framework sets a clear pathway for integrating ESG principles into financing decisions. It is grounded in global sustainability standards and aligned with the United Nations Sustainable Development Goals.

Guillaume Dalais, Group Chief Executive of CIEL Limited, described the initiative as a turning point in the group’s sustainability journey. “This Framework allows us to formally align our financing decisions with our sustainability ambitions,” he noted. “It reflects the dedication of our teams and partners, and provides clear guidance on capital allocation with strict criteria, transparent reporting and measurable outcomes.”

Developed over 18 months in close collaboration with MCB Capital Markets, the framework outlines governance processes, KPIs and eligible project categories that will guide future financing. These include investments in renewable energy, energy efficiency, green buildings, water and wastewater management, access to essential services, employment generation and gender inclusion.

Anish Goorah, Senior Vice President at MCB Capital Markets, highlighted the level of trust involved. “The development of this framework began with a shared ambition. We’re proud to have advised CIEL through every step of this journey and look forward to its implementation.”

Raising the bar for sustainable finance in Mauritius

Structured in line with ICMA’s Green, Social and Sustainability-Linked Bond Principles, and the standards of the Loan Market Association, the framework allows flexibility across various financing instruments. These include green bonds, social bonds, and sustainability-linked loans or bonds.

The initiative also benefitted from the support of FSD Africa, a UK Government development agency, which funded the Second Party Opinion provided by Morningstar Sustainalytics UK. This independent assessment brings additional rigour to future issuances under the framework and strengthens its credibility in the market. Mark Napier, CEO of FSD Africa, underlined the regional significance: “We supported this initiative as it aligns with our mandate of greening and deepening capital markets across Africa. Seeing more investment groups commit to climate-positive and resilient strategies enhances the long-term sustainability of our economies.”

For MCB Capital Markets, the transaction underscores its ability to deliver strategic, context-aware solutions that meet both international standards and regional realities.

“This collaboration sets a precedent for sustainable finance frameworks in Mauritius and the broader region,” said Rony Lam, CEO of MCB Capital Markets. “It showcases our ability to broaden access to sustainable finance solutions in line with international best practices.”

Driving systemic change through collaboration

The initiative also reflects a larger shift within MCB Group, as sustainability becomes more deeply embedded across its business lines. Building on its own Sustainable Finance Framework launched in 2024, the Group continues to invest in internal capabilities and external partnerships that accelerate the transition to inclusive and climate-conscious growth.

Jean Michel Ng Tseung, CEO of MCB Group, placed this collaboration within the broader context of the Group’s long-term ambitions. “We strongly believe in creating a sustainable and inclusive future for the customers and communities we serve,” he said. “This collaboration with CIEL Group reaffirms our commitment to driving positive change and being an inspiring player in our home markets.”

As global investors increasingly demand ESG-aligned financing, initiatives like this signal that Mauritian institutions are not only catching up, but helping shape the regional agenda. By pairing strategic intent with technical execution, the CIEL–MCB partnership sets a new benchmark for what responsible finance can look like in practice.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.