- Home

- Investor Centre

- Sustainability

- Talent

- News

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- MCB Offices

Contact Info

Financial market analysis: The 2025 gold rush

Gold prices have surged from $2,000 per ounce in early 2024 to nearly $2,800 by December, pushing toward the $3,000 mark in 2025. This historic rally is driven by central bank demand, geopolitical uncertainty, and investor appetite for safe-haven assets amid economic instability. Analysts predict gold could reach $3,100 by year-end, but questions remain about the sustainability of this surge.

Key Drivers of the Gold Rally

Inflation Concerns – Massive monetary expansion has fuelled inflation, prompting investors to hedge against currency devaluation by increasing gold holdings.

Geopolitical Uncertainty – Heightened global tensions, particularly involving the U.S., have reinforced gold’s appeal as a safe-haven asset.

Central Bank Buying – China and India are purchasing gold while reducing U.S. Treasury holdings, signaling a shift in global reserves.

Market Dynamics – Disparities between COMEX gold futures and London’s spot prices have impacted supply and demand balances, driving physical gold movement.

The Role of COMEX Inventories

A key factor behind rising prices is the sharp increase in COMEX vault inventories. Between December 2024 and February 2025, gold stockpiles in the three largest COMEX vaults rose by 15 million ounces (115%), surpassing levels seen during the 2020 pandemic. This accumulation suggests banks may be covering large short positions, historically a precursor to major price shifts.

Gold’s Unusual Correlation with Equities

Unlike past cycles, gold’s rally has coincided with strong stock market gains. The S&P 500 has performed well, suggesting investors are balancing high-performing equities with safe-haven assets. However, this raises concerns—if equities correct sharply, liquidity pressures could force gold sell-offs.

Central Banks Accumulating Gold

China – The PBoC resumed purchases in November 2024, adding 5 tonnes to its reserves, bringing total holdings to 2,264 tonnes (5% of its reserves).

India – The RBI increased its gold reserves by 8 tonnes in November, pushing annual purchases to 73 tonnes, reflecting efforts to diversify forex reserves.

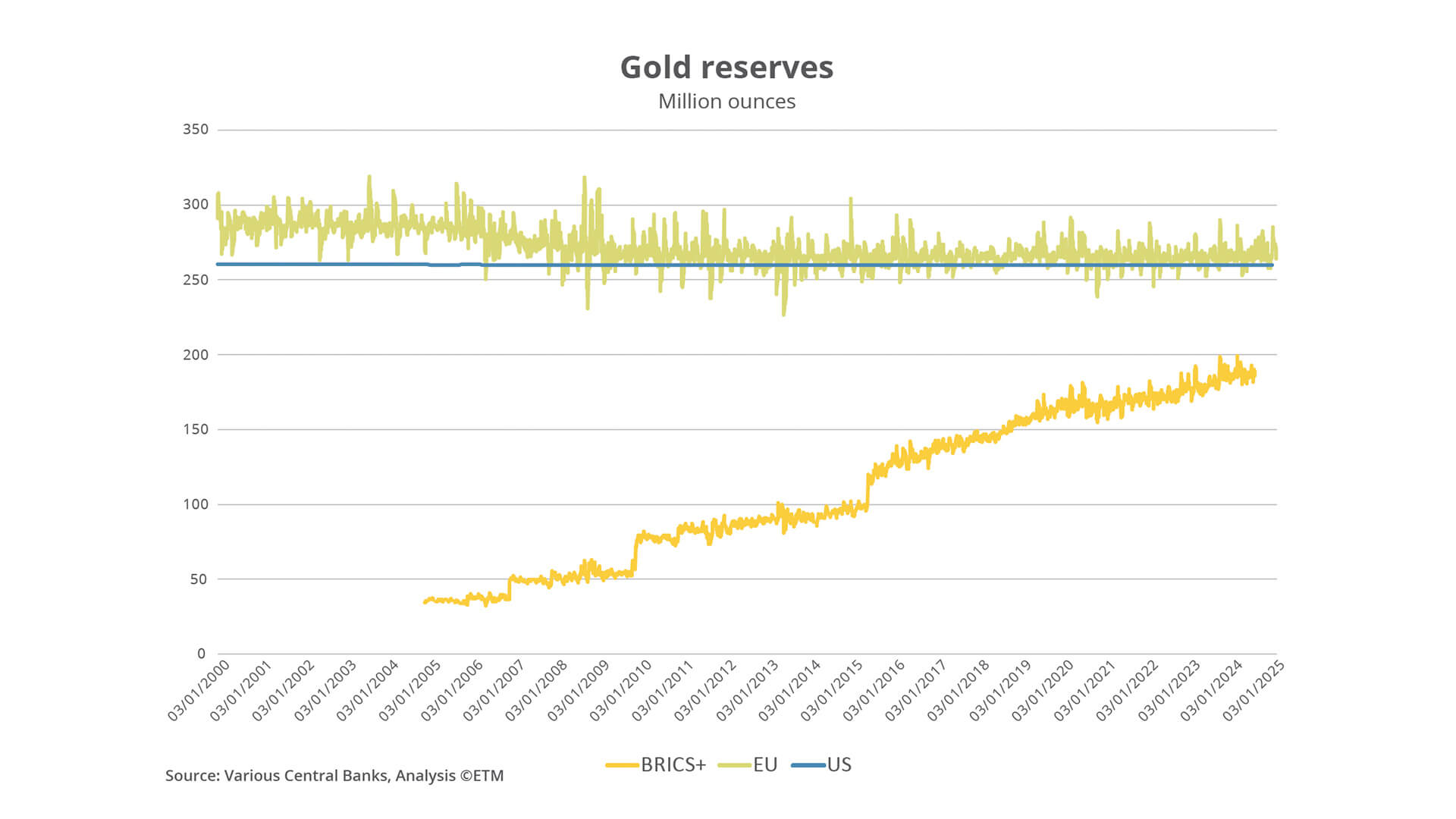

Combined, China and India's gold buying has significantly pushed up the volume of gold reserves being held by BRICS countries compared to the EU and US. This trend highlights a broader shift among central banks to reduce reliance on traditional foreign exchange holdings.

Market Sentiment and Risks Ahead

Futures markets signal continued optimism, but downside risks remain:

Geopolitical Resolutions – A peace deal in the Russia-Ukraine war could weaken gold’s safe-haven demand.

Economic Stabilization – Lower inflation and stronger global growth could shift investor focus toward higher-yielding assets.

Market Corrections – A sharp stock market correction could force liquidity-driven gold sell-offs.

A Gold Market at a Crossroads

Gold’s climb toward $3,000 per ounce underscores the strength of this rally, fueled by central bank purchases, geopolitical tensions, and inflation fears. However, risks are mounting—rising COMEX inventories suggest institutional caution, while gold’s correlation with equities raises market stability concerns. As gold trades at record highs, market volatility looms, requiring close monitoring of macroeconomic trends and policy shifts.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partners, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.