- Home

- Investor Centre

- Sustainability

- Talent

- News

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- MCB Offices

Contact Info

China's Slowdown Threatens Africa: Commodity Slump, Debt Pressures, and Growth Challenges Loom

A slowdown in economic activity in China will affect African economies through several linkages, most notably trade and debt repayments. Firstly, any slowdown in economic growth in China will cascade into lower commodity demand, weighing on prices and export revenue. This is particularly negative for African economies that tend to be undiversified and heavily reliant on commodity cycles, which renders their currencies more volatile. Lower commodity prices weigh on government revenue collections and lead to currency depreciation, raising the cost of servicing foreign-denominated debt.

Secondly, many African countries are highly exposed to Chinese debt. China is pressuring financially strained developing markets to repay their existing debts just when these economies are under increased pressure (partly due to China’s slowdown). Instead of offering debt relief to its debtors, China prefers to extend short-term credit swaps and loan rollovers, a move that has been criticised. Furthermore, it has been responsible for some (not all) delays accompanying international debt relief initiatives, such as the G20 Common Framework. During Zambia’s recent debt restructuring, for example, China was accused by US Treasury Secretary Janet Yellen of being a ‘barrier’ to ending the country’s debt crisis. She further stated that China engaged in ‘debt trap diplomacy’, as the creditor exerts political and economic leverage over the indebted country when it defaults, often in the form of control over strategic assets, resources, or policy decisions. Zambia, the first country to undergo the process under the G20 common framework, owes around a third of its debt to China. Angola, Ethiopia, Kenya, Zambia, Egypt and Nigeria are African countries with significant Chinese debt exposure. Ethiopia owes around $6.8bn to China and is undergoing debt restructuring under the same G20 framework.

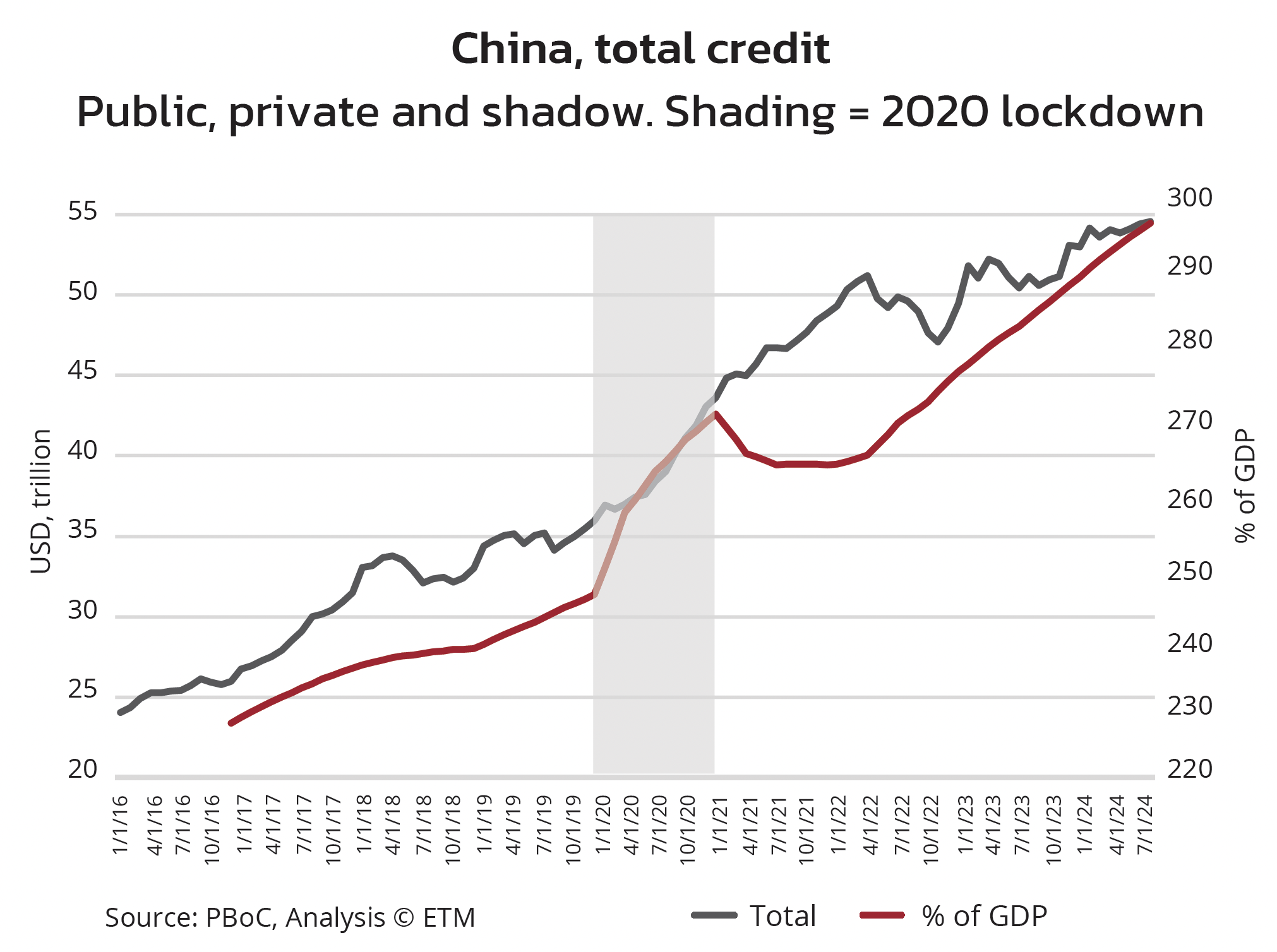

Nonetheless, China is facing its own debt crisis, with levels closing in on $55tn, accounting for almost 300% of its GDP. Perhaps China is refusing debt relief simply because it cannot risk adding more debt to its own books in the face of downside risks.

Thirdly, after years of being a driving force of investment on the African continent, funding has slowed notably since 2019. A report from Boston University's Global Development Policy Centre reveals that more than half of the loans issued by China last year were channelled to regional and national financial institutions to reduce risk by minimising direct involvement with the debt issues of individual African nations. Additionally, nearly 10% of the 2023 loans were allocated to renewable energy initiatives, signalling a move towards more sustainable energy solutions.

Slowing Chinese economic growth will weigh on economic growth in African countries that have come to rely on Chinese investments for development. This will also allow other global players (e.g., India) to increase their influence on the continent.

With Chinese risks increasing, a Chinese downturn will have a severe impact on African economies. An IMF study published in late 2023 indicated that every 1% decline in China's GDP growth resulted in a 0.25% decline in its trading partners' economies.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partner, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.