MCB Group Annual Report 2025

Discover our Annual report, providing a holistic view of how MCB Group creates, delivers and preserves value for all its stakeholders.

Download

Financial

performance

Net profit

+12.6%

Total assets

+7.3%

Shareholder

value

Earnings per share

+10.2%

Dividend per share

+10.9%

Market

positioning

Customer loans

-1.1%

Customer deposits

+7.9%

Efficiency and

return ratios

Cost-to-income

+64 bps

Return on equity

-27 bps

Asset quality & capitalisation

Gross NPL ratio

-9 bps

Capital adequacy ratio

+148 bps

Employees

Workforce

Women at middle and

senior management level*

Trust index

MCB Group has been accredited

Great Place to Work®

Customers

Overall customer base

Net Promoter Score*

Shareholders

and investors

Market capitalisation on

Stock Exchange of Mauritius (SEM)

First on the local stock market

Long-term / short-term deposit ratings - Moody's Ratings*

Economies,

societies and

communities

Amount spent by MCB Forward Foundation

MCB Group MSCI

ESG Rating

Cash to digital

payment ratio*

of the total value added generated in Mauritius*

of the total value added generated in Seychelles

of total corporate tax paid in Mauritius*

Inclusive of levies on income

* Relates to MCB Ltd

Note: Figures are as at 30 June 2025, unless otherwise stated

Maya Makanjee, Stephen Davidson, Jean Michel Ng Tseung, Anna Margaretha Roets, Jayananda Nirsimloo, Constantine Chikosi, Georges Michael David Lising, Marivonne Oxenham (Secretary to the Board), Yvan Legris, San T Singaravelloo and Dipak Chummun

Absent: Cédric Jeannot

Audit Committee

Corporate Strategy Committee

Cyber and Technology Risk Committee

Renumeration, Corporate Governance, Ethics and Sustainability Committee

Risk Monitoring Committee

Supervisory and Monitoring Committee

Committee Chair

Committee Member

Chairperson

Independent Non-Executive Director

Group Chief Executive

Executive Director

Group Chief Finance Officer

Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

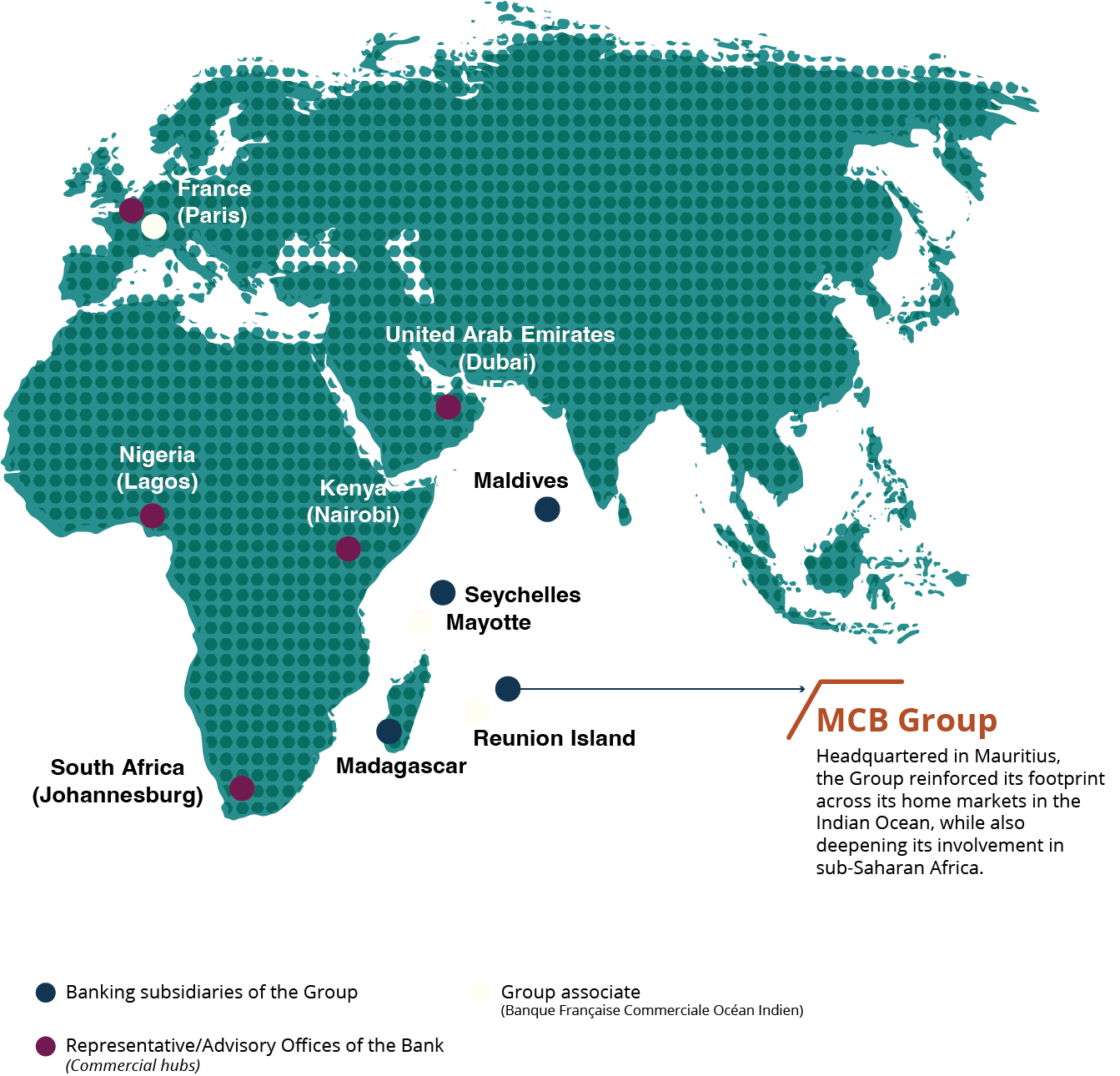

MCB Group is a reputable and prominent regional banking and financial services provider, offering a comprehensive range of tailored and innovative solutions through its local and foreign subsidiaries and associates.

Deposit ratings

Relates to MCB Ltd

Issuer rating

Pertains to the servicing of financial obligations in Mauritius

Constituent of SEM Sustainability Index and awarded an ‘A’ MSCI ESG rating

Branches/kiosks

ATMs

MCB Juice subscribers

Presence in

Wide network of correspondent banks

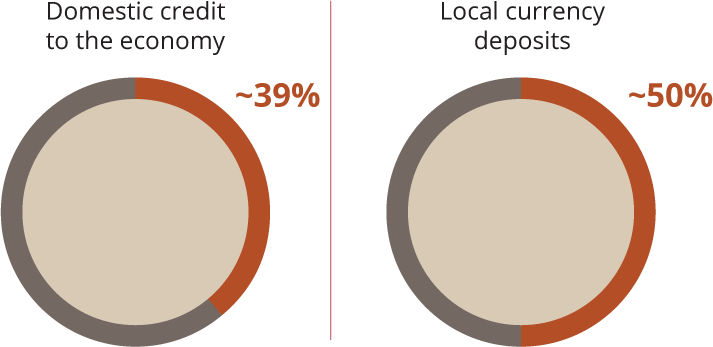

Domestic credit to the economy

Local currency deposit

of SEMDEX1

Ordinary shareholders (Individual shareholders account for 46.2% of the ownership base)

Preference shareholders & bondholders

Notes:

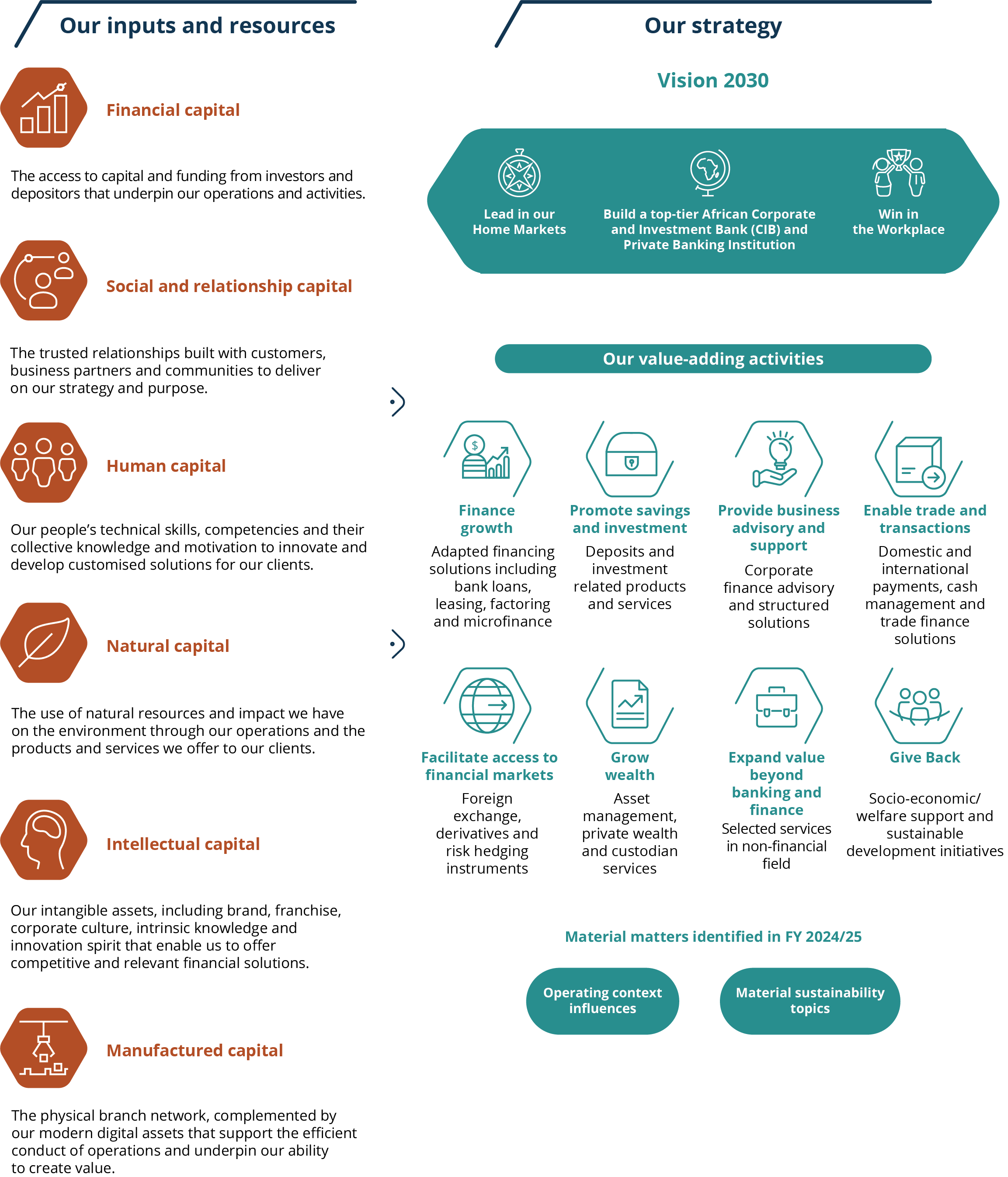

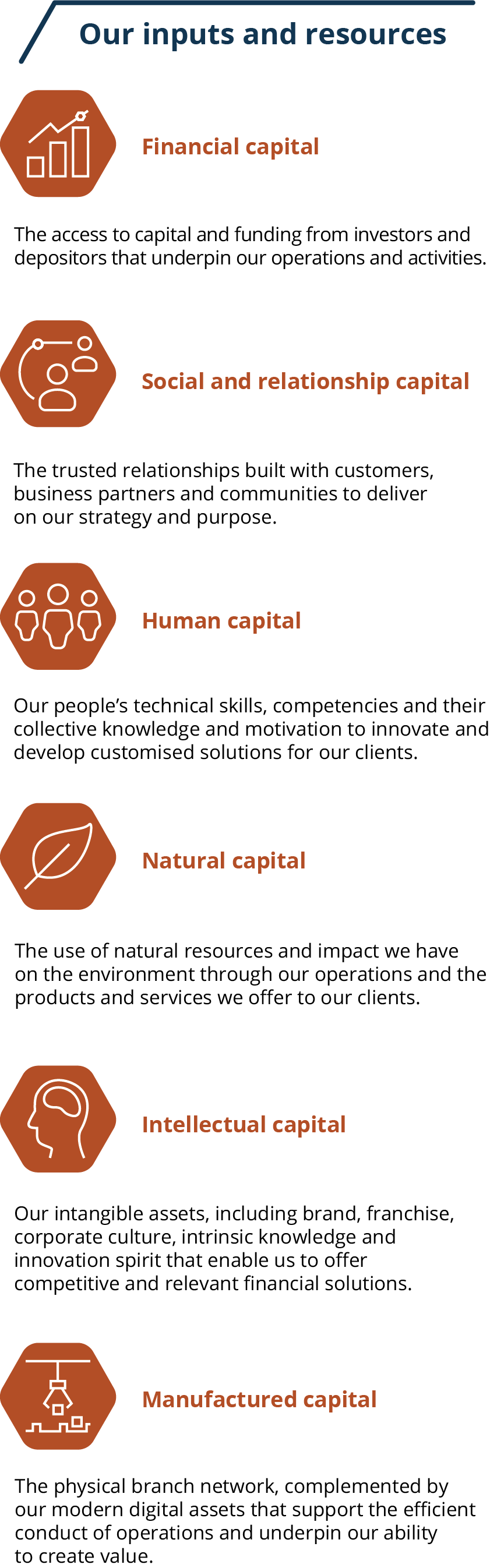

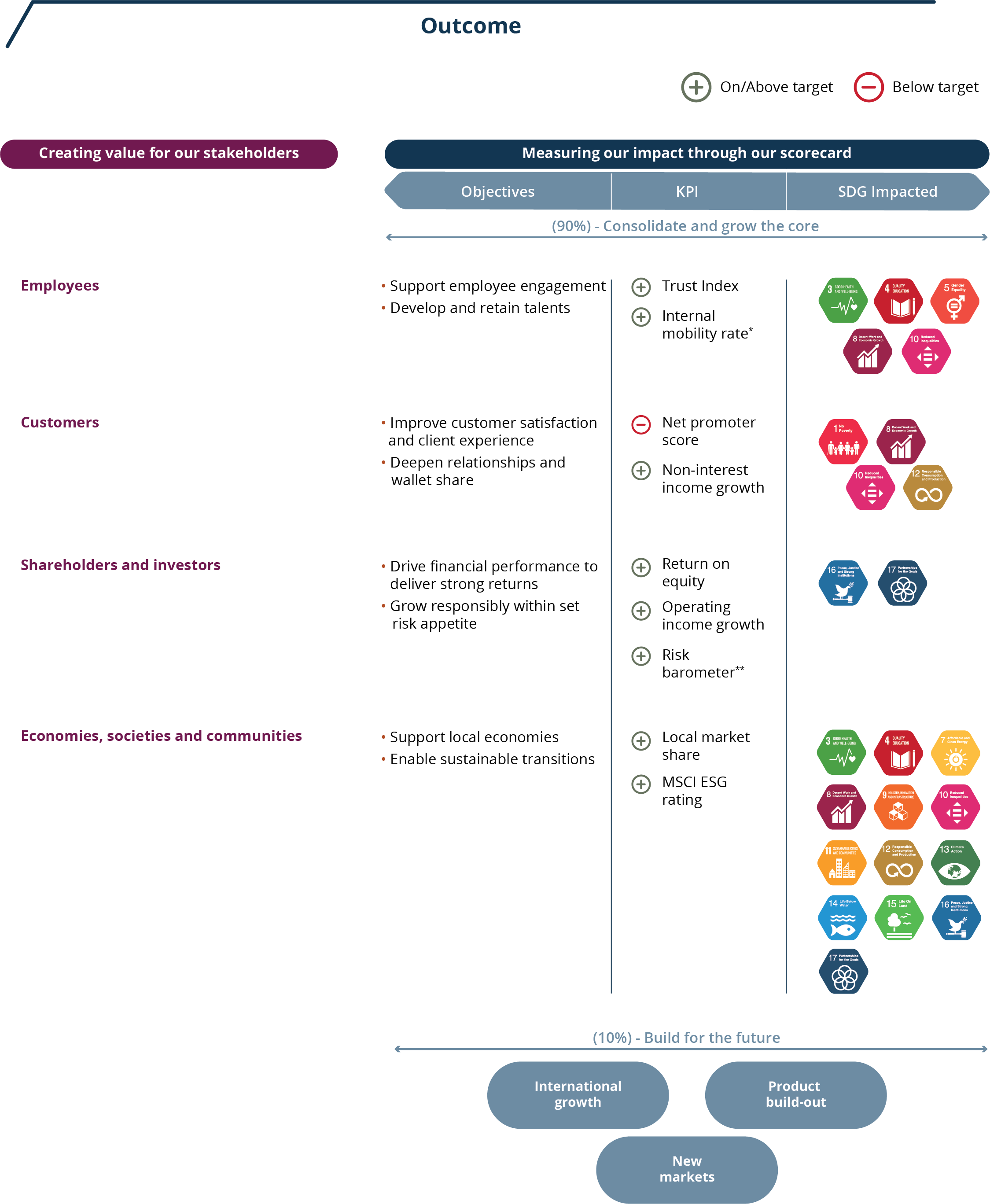

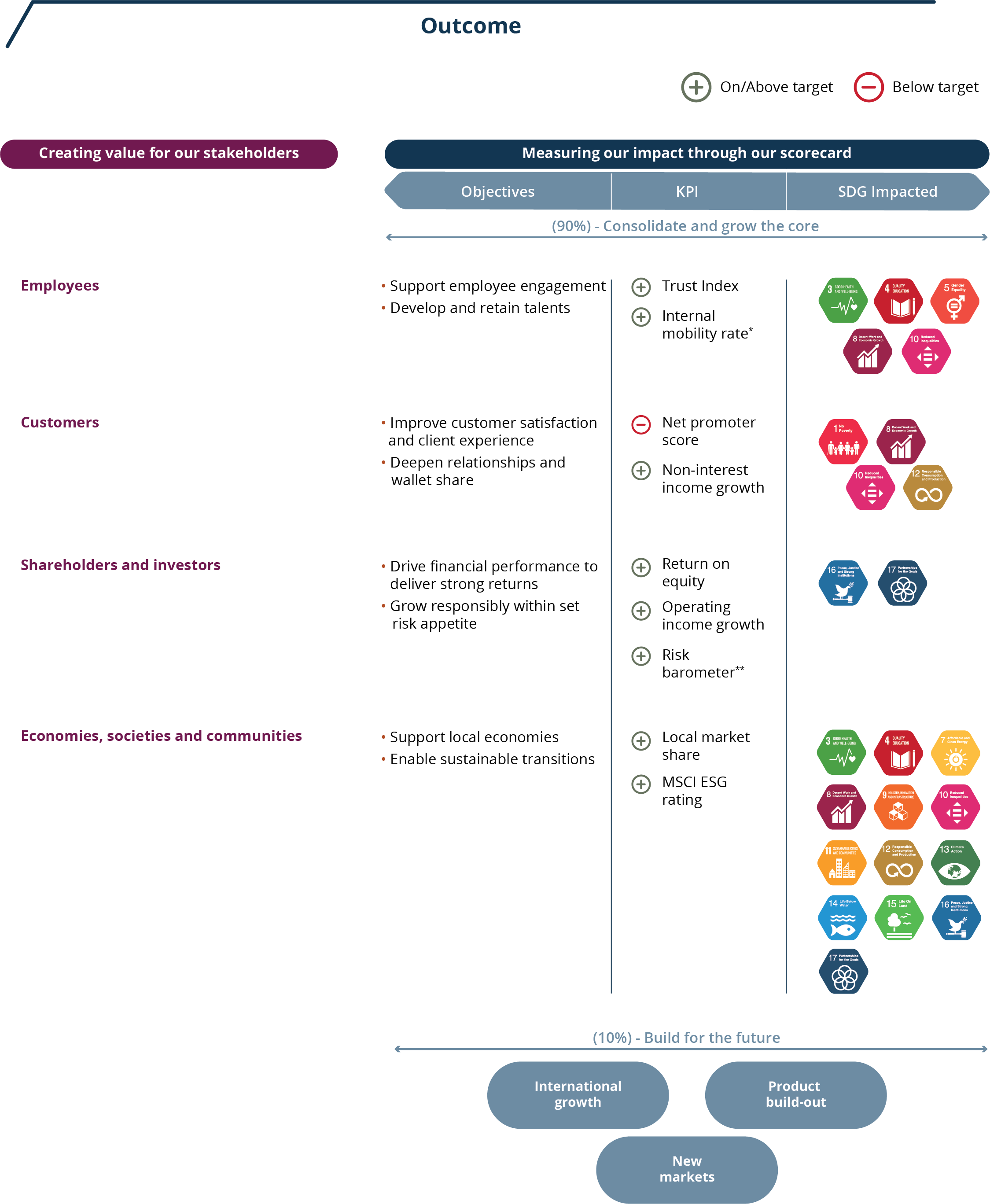

Our value creation model illustrates how we deploy our resources and expertise to generate long-term value for our stakeholders. By aligning our activities with our strategic priorities and responding to material matters, we generate both financial and non-financial outcomes while safeguarding against value erosion.

Notes:

* Proportion of vacancies filled internally

** Derived from a composite index that integrates compliance, financial and non-financial risks

Guided by the ambition outlined in Vision 2030, we have defined our strategic priorities to shape our direction and actions over the next five years in a fast-changing world. These priorities are articulated around three pillars (i) leading in our home markets, namely Mauritius, Madagascar, Seychelles and Maldives by driving innovation, uplifting customer experience and supporting inclusive economic development; (ii) establishing ourselves as a top-tier Corporate and Investment Bank and Private Banking institution in Africa, contributing to the continent’s socio-economic progress through trade, investment and support for a just transition; and (iii) creating a winning workplace that empowers people and fosters innovation. In doing so, we seek to create lasting value for our stakeholders and contribute to a sustainable and inclusive future.

The Board of MCB Group Ltd is committed to upholding high standards of corporate governance to support the organisation's long-term success and create sustainable value for all its stakeholders. The Board provides purpose-driven and ethical leadership, setting the tone from the top in the way that it conducts itself and oversees the management of the Company (refers to MCB Group Ltd on a standalone basis) and of its subsidiaries. The Board believes that good governance is fundamental to reinforcing the Group's values and culture by promoting accountability, transparency, effective risk and performance management, robust internal control, responsible stakeholder engagement and ethical behaviour across the organisation.

The Board of the MCB Group Ltd has continued to actively monitor and adapt its governance frameworks and practices in light of the increasingly dynamic and complex operating environment over the last financial year. In this respect, particular attention has been given to risks and developments relevant to the financial services industry including macroeconomic uncertainty amidst geopolitical tensions, heightened regulatory demands, digital transformation and cybersecurity threats, evolving workplace dynamics, and customer experience in a competitive landscape. Directors also pursued ongoing training to stay abreast of emerging issues and strengthen their oversight capabilities, in line with the Group's commitment to sound corporate governance. The Group's Corporate Governance Framework is anchored on the four pillars highlighted hereunder.

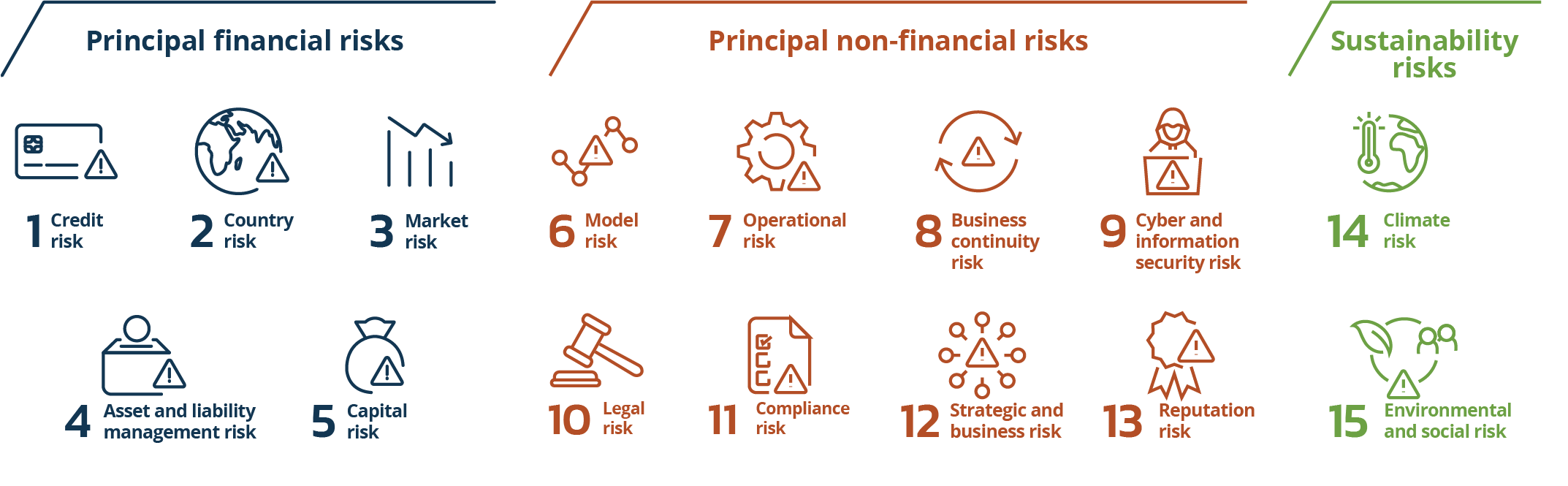

The environment in which we operate remained complex and volatile, with persistent headwinds influencing our operations, though the relative easing in monetary policy provided some relief to global financial conditions. In this uncertain context, our overall risk profile stayed within the established limits of our risk appetite, underpinned by robust and proactive risk management practices across the Group. We continued to actively identify and assess risks from both external and internal sources, enabling us to address potential threats and capture opportunities. In this regard, we updated our Enterprise Risk Heat Map to reflect the unfolding risk landscape and prioritise risks that could materially affect our operations, financial performance, solvency, or strategic direction.

During the year, significant progress was made in enhancing the Group's risk management framework. A key focus was laid on operationalising Group-level risk oversight to drive greater consistency in standards and practices across all subsidiaries. Country risk management was further strengthened through targeted visits led by our newly appointed Senior Country Risk Officer, who brings deep African expertise. Recognising the growing complexity and scale of financial market activities, we formalised, at the level of MCB Ltd, a Board-level risk appetite for Market Risk and Asset and Liability Management (ALM), previously set and overseen by ALCO, to enhance strategic governance. The Group further embedded a strong risk culture across the organisation through awareness sessions, training courses and social engineering exercises. We also reinforced risk function capabilities as gauged by the successful completion of the Risk Academy pilot phase and launched a focused Employee Value Proposition to support retention and development.

The most prominent external influences impacting our risk landscape in FY 2024/25 were related to challenging geopolitical and macroeconomic conditions, heightened regulatory and fiscal requirements, rising climate, environmental and social considerations, rapid technological change and evolving cybersecurity threats, shifts in workplace dynamics and employee engagement, and the need to enhance customer experience in a competitive landscape. A description of these factors and our response thereto is provided on pages 36 to 40. To ensure appropriate coverage, we have defined the following key risks that impact our business, with the list pertaining only to major risks and thus not exhaustive.

Stay up-to-date with our latest releases delivered straight to your inbox.

Don't hesitate to contact us for additional info

Keep abreast of our financial updates.