MCB Group Annual Report 2024

Download

Financial Performance

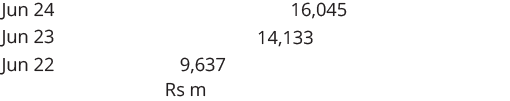

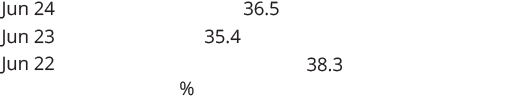

Net profit

+13.5%

Total assets

+12.9%

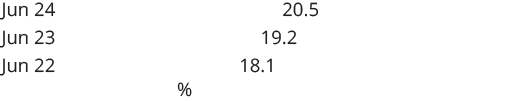

Shareholder value

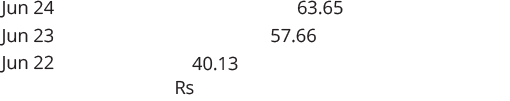

Earnings per share

+10.4%

Dividend per share

+13.6%

Market positioning

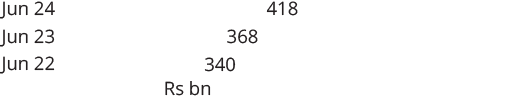

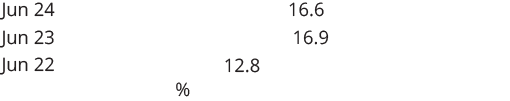

Customer loans

+13.6%

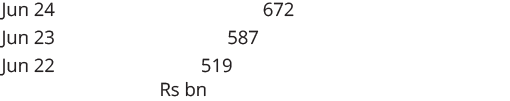

Customer deposits

+14.5%

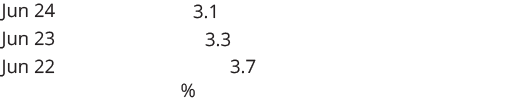

Efficiency & return ratios

Cost to income

+110 bp

Return on equity

-23 bp

Asset quality & capitalisation

Gross NPL ratio

-21 bp

Capital adequacy ratio

+129 bp

Employees

Workforce

Women at middle and senior management level*

Employee retention rate

Customers

Overall customer base

Individual customers

Non-individual customers

Net Promoter Score*

Customer satisfaction score*

MCB Juice subscribers

Shareholders and investors

Market capitalisation on

Stock Exchange of Mauritius (SEM)

First on the local stock market

Long-term / short-term deposit ratings –

Moody’s Ratings*

Economies, Societies and Communities

Amount spent by MCB Forward Foundation

of the total value added generated in Mauritius*

MCB Group MSCI ESG Rating

of the total value added generated in Seychelles

Cash to digital payment ratio*

of total corporate tax paid in Mauritius*

* Relates to MCB Ltd

Note: Figures are as at 30 June 2024, unless otherwise stated

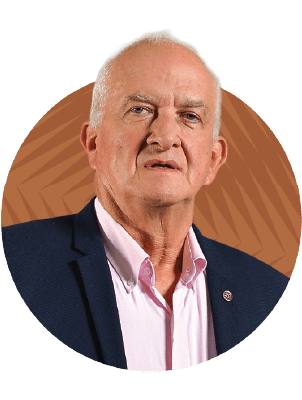

Chairperson

Independent Non-Executive Director

Group Chief Executive

Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

Independent Non-Executive Director

MCB Group Corporate Services

Re-elected during the Annual Meeting of Shareholders held in November 2023

Joined the Board

Left the Board

MCB Group is an integrated financial services provider, offering customised products and services to a wide range of clients through its local and overseas subsidiaries and associates.

Deposit ratings

Relates to MCB Ltd

Issuer rating

Pertains to the servicing of financial obligations in Mauritius

Constituent of and awarded an MSCI ESG rating

of local currency deposits

of domestic credit to the economy

of SEMDEX1

Ordinary shareholders (Individual shareholders account for 45.8% of the ownership base)

Preference shareholders & bondholders

Notes:

Figures are as at 30 June 2024

1excludes foreign currency denominated, GBL and international companies.

Note:

The use by MCB Group of any MSCI ESG research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of MCB Group by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided 'as-is' and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

We use our resources and expertise to create and protect value while minimising the risk of value erosion.

We recognise the challenges of operating in a volatile environment and remain steadfast in our commitment to making a meaningful and positive impact. To translate this conviction into tangible results, we have anchored our efforts in fulfilling our purpose, Success Beyond Numbers, which serves as the cornerstone of our strategy. This purpose drives us to go beyond financial metrics, focusing on creating lasting value for our stakeholders, fostering innovation, and building resilient communities.

Throughout the year, we continued to make headway on our 3-year rolling plan, strategically positioning ourselves to seize opportunities in an ever-evolving landscape. Guided by our proven business model, our strategy focuses on delivering sustained earnings by becoming more diversified, digital and sustainable. As we continue our efforts to make MCB Group a simpler and more efficient organisation, we are focused on delivering excellent customer service and customised offerings, capitalising on our talented workforce while operating within the precinct of our risk appetite.

The Board of MCB Group Ltd is committed to applying high standards of corporate governance with a view to fostering the organisation's long-term business sustainability and creating value for all its stakeholders whilst acting for the good of society. The Board provides purpose-driven and ethical leadership by setting the tone from the top in the way that it conducts itself and oversees the management of the Company (refers to MCB Group Ltd on a standalone basis) and of its subsidiaries. It believes that good governance is essential in upholding the Group's values and culture through the promotion of accountability, transparency, effective risk and performance management, robust internal control, responsible stakeholder engagement and ethical behaviour by all employees across the organisation. In view of the fast-changing and increasingly challenging environment, the Board continuously monitors and adapts its governance practices and frameworks to incorporate the implications of major developments, pertaining to, inter alia, the geopolitical and macroeconomic conditions, heightened regulatory demands, climate, environmental and social considerations, cybersecurity and technological disruptions, workplace transformations and employee engagement as well as customer loyalty in a competitive market. MCB Group's strong performance in the 'Corporate Governance Scorecard Assessment' exercise of listed companies conducted by the National Committee on Corporate Governance (NCCG) in 2023 reflects its commitment to the application of the principles set out in the Code. The Group's Corporate Governance Framework is anchored on the four pillars highlighted hereunder.

Notwithstanding gradual improvements witnessed in some areas, the risk landscape remained volatile in FY 2023/24 on account of persistent challenges in our internal and external operating environments with the economic situation in key African markets, for instance, further retaining our attention. Nevertheless, our risk profile stayed within established limits of our risk appetite, thanks to the stringent policies, processes, and proactive risk management practices in place across the Group. We continued to actively identify and assess risks from both external and internal sources, enabling us to address potential threats and unlock opportunities. We accordingly reviewed our Enterprise Risk Heat Map to cater for the dynamic environment and focus on the risks that could have a significant impact on the Group’s operations, financial performance, solvency, or strategic direction. We made further headway in embedding a strong risk culture across the organisation through the implementation of the Risk Culture Programme to guide the right behaviours in the conduct of our operations with key themes emphasised during the year being cyber and physical security amongst others. As a key move to strengthen the risk governance and oversight, the Risk and Compliance functions of MCB Ltd have been elevated at the Group level since August 2023. Subsequently, the latter functions initiated a gap assessment exercise across subsidiaries during the year with the objective of reinforcing and aligning risk management practices within the organisation.

During the year under review, the most prominent external influences impacting our risk landscape related to geopolitical and macroeconomic conditions, heightened regulatory demands, climate, environmental and social considerations, cybersecurity and technological disruptions, workplace transformations and employee engagement as well as customer loyalty in a competitive market. A description of these factors and our response thereto is given on pages 36 to 39. To ensure appropriate coverage, we have defined the following key risks that impact our business, with the list pertaining only to major risks and is thus not exhaustive.

Stay up-to-date with our latest releases delivered straight to your inbox.

Don't hesitate to contact us for additional info

Keep abreast of our financial updates.