- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Iran-Israel clash: Africa braces for potential oil shock and economic fallout

The escalating Iran-Israel conflict, sparked by Israel’s strikes on Iran’s proxies and military infrastructure, has plunged the Middle East into a volatile state. Iran’s “axis of resistance” is faltering: Syria’s Assad regime has collapsed, Hezbollah and Hamas are weakened, and low oil revenues strain Tehran’s finances. Israel, led by Prime Minister Benjamin Netanyahu, aims to curb Iran’s nuclear ambitions and may pursue regime change. Given the fluid nature of the conflict, outcomes remain uncertain as both sides navigate military, economic, and geopolitical pressures.

Economic pressures on Iran

Prior to Israel’s recent actions, Iran faced mounting economic challenges. Sanctions on its shadow fleets, which transport oil primarily to China, intensified through May 2025, reducing exports to some of the lowest levels in five years—approximately 1.8–2 million barrels per day (bpd). According to the U.S. Energy Information Administration (EIA), Iran’s oil production stands at 4.75 million bpd, a significant portion of global supply. OPEC’s surplus capacity, around 4 million bpd, could theoretically offset disruptions, but scaling up production requires time and logistical coordination. A significant disruption to Iranian output could tighten global oil markets, driving price volatility.

The Strait of Hormuz: A global chokepoint

The Strait of Hormuz, through which 20–25% of global oil (roughly 20 million bpd) and substantial LNG exports flow, is a critical flashpoint. Iran could disrupt this vital artery using mines, missiles, or naval forces, potentially spiking oil prices by 20–50% (to $84–$114/barrel, based on a June 23 Brent price of $71.68/barrel). Tankers are already switching off beacons to avoid targeting, increasing the risk of collisions and minor disruptions. The U.S. military, with bolstered assets in the region, will likely play a pivotal role in keeping the strait open to prevent severe economic fallout. A partial closure would inflate oil prices, disrupt global energy markets, and heighten uncertainty.

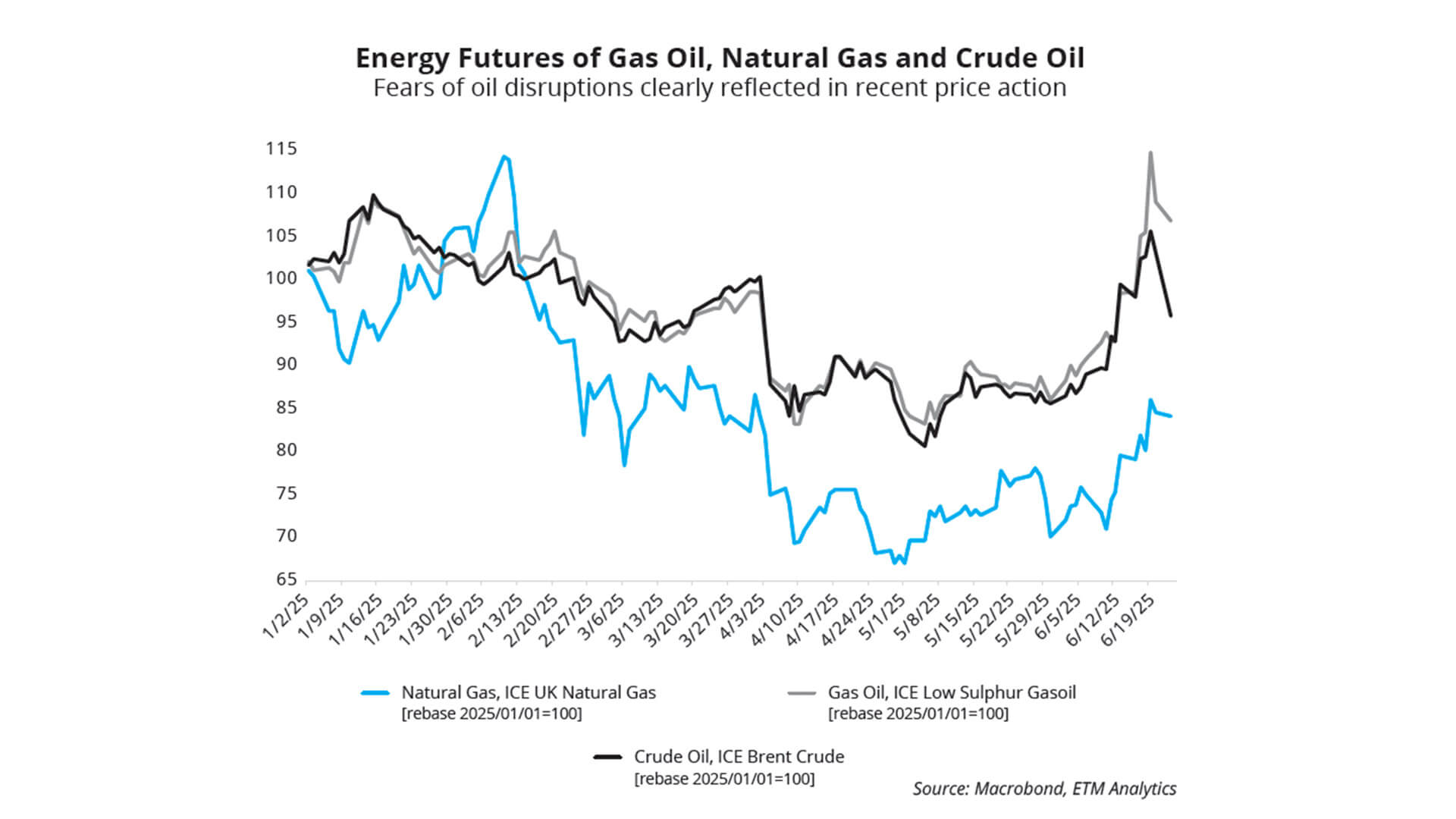

Oil prices and freight costs as barometers

Oil prices have surged in recent weeks, reflecting fears of supply disruptions. On June 23, 2025, Brent crude fell to $71.68/barrel, down 7.23% from the previous day, but up 11.09% over the past month. Whilst no major production interruptions have occurred, sanctions are pressuring shipowners to avoid Iranian oil, complicating logistics. Freight costs from the Arab Gulf to China have soared 180% since 12 June 2025, with rates for very large crude carriers rising over 20% and clean product tankers jumping from $3.3–$3.5 million to $4.5 million. Charterers are cautious, and prolonged tensions could further inflate costs and insurance premiums. Saudi Arabia and the UAE have spare capacity, but scaling up is not instantaneous, potentially leading to short-term price pressures and inflationary consequences.

Financial market implications

The conflict’s ripple effects are evident across financial markets:

- Oil Prices: Brent crude could exceed $112/barrel, with a Hormuz disruption potentially pushing prices to $156/barrel, particularly impacting emerging markets (EMs).

- Gold Prices: Safe-haven demand may drive gold above $4,000/oz

- Emerging Markets: Volatility could pressure EM currencies and equities, especially in oil-importing nations.

- U.S. Interests: Energy firms face risks, though diplomatic efforts aim to safeguard long-term investments.

Implications for Africa

Africa faces divergent impacts from rising oil prices due to the Iran-Israel conflict. Oil-importing nations like Kenya and Ghana are vulnerable to higher fuel and transport costs, exacerbating inflation, straining trade balances, and risking currency depreciation. Conversely, oil exporters such as Nigeria and Angola may benefit temporarily from increased revenues, though this windfall could be short-lived if global supply adjusts. Nigeria, despite its oil production, remains exposed due to its reliance on imported refined petroleum. Prolonged conflict could strain government budgets, reduce consumer purchasing power, and hinder economic recovery across the continent. Geopolitical tensions and war weigh heavily on market sentiment, driving capital away from high-risk African frontier markets towards safe havens, increasing financing costs and deterring foreign investment, further challenging Africa’s growth prospects.

Navigating uncertainty

The Iran-Israel conflict underscores the delicate balance of power in the Middle East. Israel’s security concerns must be weighed against Iran’s need to maintain influence, whilst global powers, particularly the U.S., work to stabilise energy markets. Oil prices and freight costs serve as critical indicators of escalating tensions, with the Strait of Hormuz remaining a key geopolitical and economic chokepoint. For now, with a fragile ceasefire in place, markets remain on edge, with historical trends suggesting short-term price spikes may ease unless major infrastructure is targeted. However, the broader implications for global economies, including Africa’s, highlight the far-reaching consequences of this volatile conflict.

For more information, please contact MCB Global Markets Team on [email protected]

Published in collaboration with our Financial Markets research partners, ETM Group.

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.