- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

Africa’s FX Story: Resilience in 2025, Selectivity in 2026

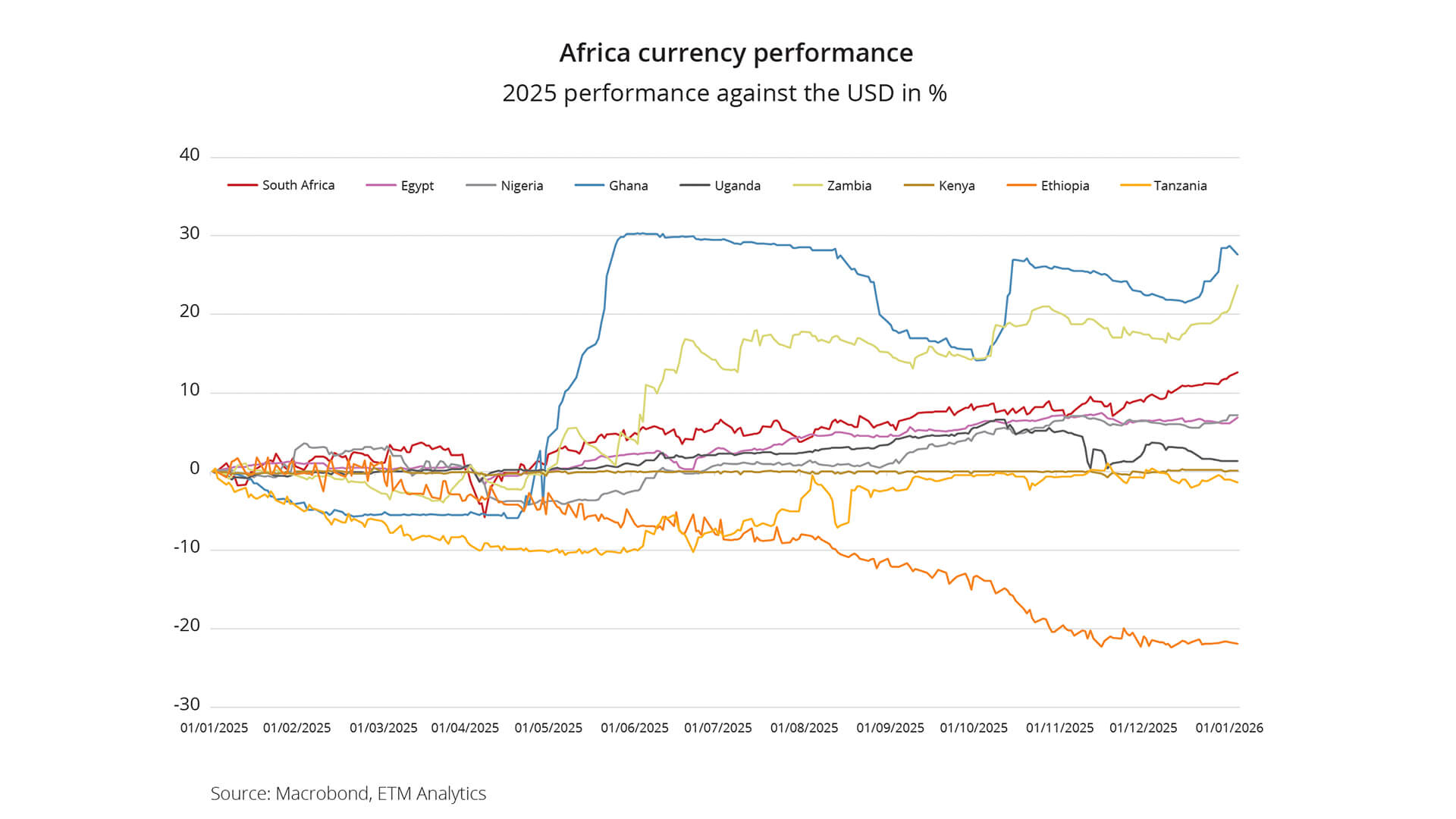

African currencies proved more resilient than expected in 2025 despite heightened global volatility. This performance was supported by improving domestic fundamentals, a weaker US dollar and a favourable external backdrop. SSA recorded record goods exports of USD 270.5bn in the first seven months of the year, up 10.5% year-on-year, driven by elevated commodity prices and stronger export volumes.

Commodity dynamics were central to FX outcomes. Softer oil prices eased fuel import bills and inflation for net importers, while weighing modestly on exporters such as Angola and Nigeria. Metals, however, provided a strong tailwind. Elevated gold prices boosted export receipts and allowed central banks to rebuild reserve buffers, supporting FX stability in Ghana, Tanzania and South Africa. In South Africa, higher platinum group metal prices, reform momentum and improved ratings dynamics helped keep the rand well supported. Zambia also benefited from strong copper prices and rising output, improving FX liquidity and stabilising the kwacha.

Beyond commodities, structural vulnerabilities and political developments drove divergences. Economies with high debt burdens, persistent current-account deficits and weak reserve buffers remained exposed. Ethiopia recorded the weakest performance, with the birr continuing to depreciate following exchange-rate liberalisation. Elsewhere, political uncertainty triggered episodic volatility, including around Kenya’s aborted tax increases and election-related dollar hoarding in Tanzania.

Looking ahead to 2026, African FX markets are expected to be shaped by sustained economic momentum, still-elevated but gradually normalising commodity prices, and an improving external environment. While easing inflation and lower interest rates should support domestic demand and growth, they may also lift import demand and FX pressures in some economies.

However, performance will remain highly selective. Zambia’s kwacha is well positioned to outperform, supported by strong copper fundamentals and progress on debt restructuring, albeit with some election-related volatility. Uganda’s FX outlook should improve in the second half of the year as oil-related inflows materialise. Several currencies are expected to remain broadly stable, including South Africa’s rand, Kenya’s and Tanzania’s shilling, underpinned by active central bank management, adequate reserves and resilient export performance. By contrast, the Ethiopian birr is likely to remain under pressure amid unresolved structural imbalances, while depreciation elsewhere should be gradual, with Nigeria’s naira supported by capital inflows and a current-account surplus. The opportunity set in 2026 lies less in broad-based appreciation and more in identifying economies with credible policy frameworks, improving external buffers and durable reform momentum.

Published in collaboration with our Strategy, Research and Development team and our Financial Markets research partner, ETM Group.

For more information, please contact us on [email protected]

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.