- Home

- Investors Centre

- Sustainability

- Talent

- News

- Insights

- TH!NK

- Corporate Governance

- Company Profile

- Board of Directors

- Community

- MCB Offices

Contact Info

MCB Capital Markets advises Valency International on its USD 15 million bond issuance

- This transaction marks the first time a Singapore based company has issued bonds in Mauritius to fund its operations in Africa, setting a precedent for cross-border capital flows.

- MCB Capital Markets structured and executed a bond issue, demonstrating its ability to innovate and navigate complex regulatory, credit and market considerations.

- The USD 15 million bond issue will enable Valency International to strengthen its balance sheet and accelerate the expansion of its agri-commodities business, particularly in West Africa.

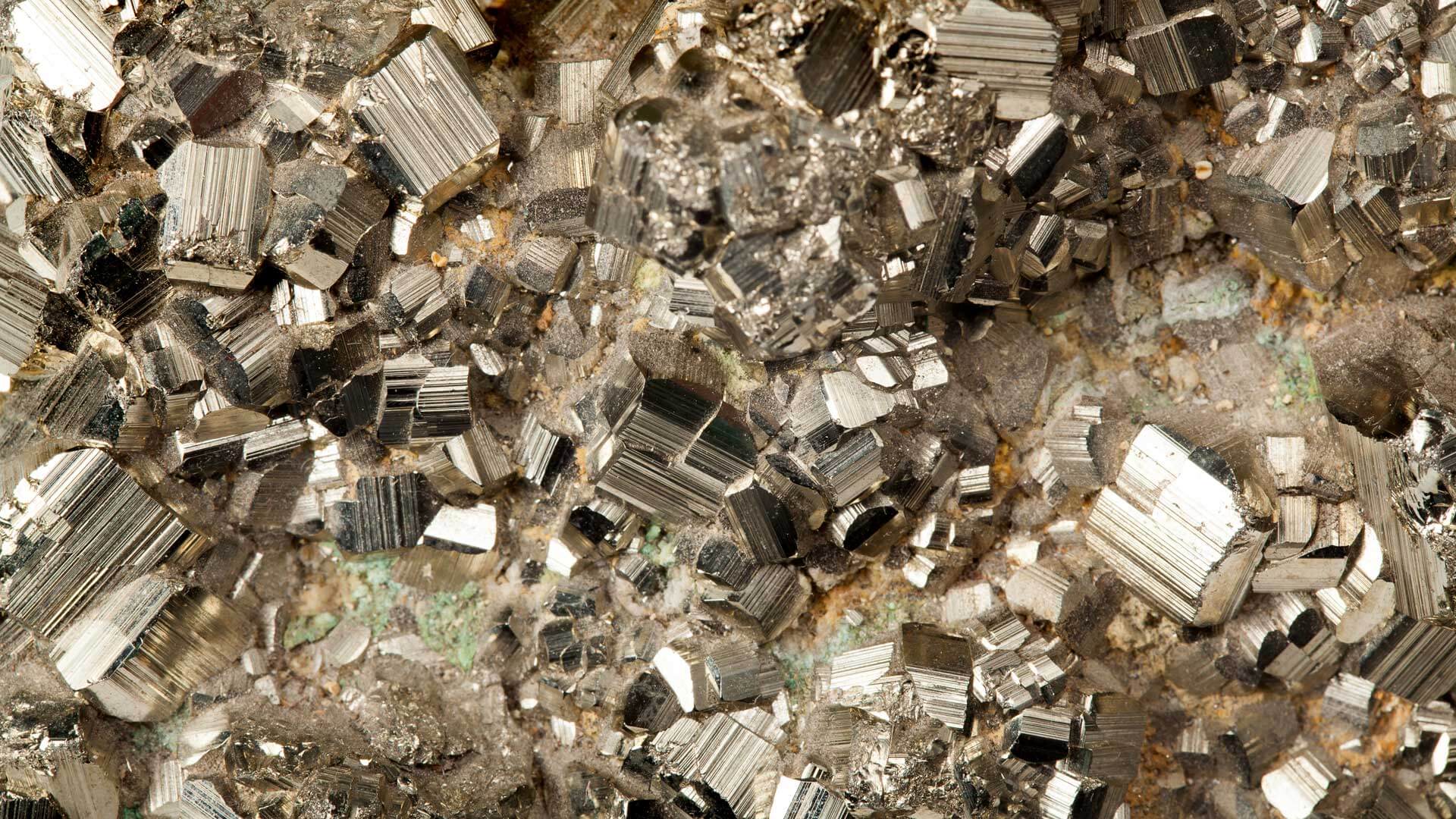

Valency International, a Singapore headquartered agri-commodities and FMCG company with operations in 22 countries, has traditionally relied on short-term working capital facilities to finance its growth. To support its ambitious plan in Africa, the group was keen to diversify its funding sources and secure longer term balance sheet financing. A bond issue in Mauritius was both an uncommon move for the sector and a strategic milestone for the company.

The Role of MCB Capital Markets

MCB Capital Markets acted as exclusive Transaction Advisor on the structuring and execution of a USD 15 million bond issue via Valency’s newly incorporated Mauritian subsidiary. The MCB team included Rony Lam, Chief Executive Officer, and Neermal Shimadry, Senior Vice President, who led the transaction and worked closely with the client to design and deliver the solution.

The bond was supported by a credit risk guarantee from Africa Solidarity Fund, a multilateral financial institution. Eversheds Sutherland (Mauritius) and Simmons & Simmons (Singapore) provided legal advice and ArchGlobal provided fiduciary services.

The bond proceeds provide Valency International with long-term funding that reinforces its financial foundation and enables accelerated expansion across the continent. Sumit Jain, CEO of Valency International, noted that “this bond issuance is a testament to investor confidence in our vision and operational strength. MCB Capital Markets played a critical role in structuring and executing the transaction from start to finish, enabling us to secure long-term funding to accelerate our global expansion plans and enhance stakeholder value.”

Reflecting on the transaction, Rony Lam commented that “it is the first time that a Singapore-based company taps the Mauritian debt capital markets for financing its operations in Africa, and we are pleased to have contributed to this milestone. This transaction underscores the role of Mauritius in bridging the flow of capital between Asia and Africa and highlights the strength of our advisory capabilities.”

Neermal Shimadry added that “supporting the growth and resilience of the agricultural sector is essential as agriculture remains a major contributor to Africa’s GDP and employment. This transaction demonstrates our continued commitment to delivering bespoke financing solutions that help our clients achieve their strategic objectives.”

Learn more about MCB Capital Markets

Subscribe to our Email Alerts

Stay up-to-date with our latest releases delivered straight to your inbox.

Contact

Don't hesitate to contact us for additional info

Email alerts

Keep abreast of our financial updates.