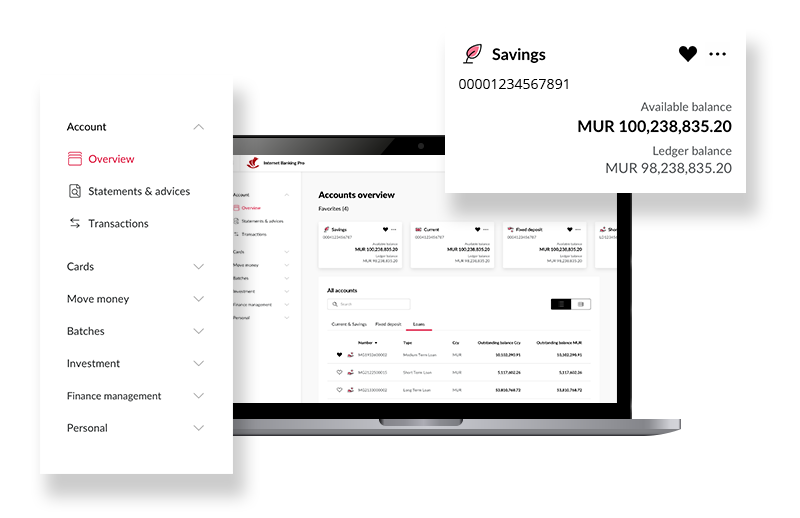

New features

GPI Tracker

Stay ahead of your financial operations with GPI Tracker, the latest feature of Internet Banking Pro. Monitor your international payments in real-time, with full visibility on payment status, location, and processing times.

Key benefits

Full visibility

Monitor your cross-border transactions in real-time with instant updates on payment statuses.

Enhanced control

Enjoy complete, end-to-end tracking for clear insights into every stage of your payment journey.

Prompt accessibility of SWIFT advices

Effortlessly access SWIFT advices and payment details, providing a smoother and faster transaction process.

Accuracy at the start

SWIFT Pre-Val strengthens your cross-border transfers by verifying beneficiary details before payment initiation. By checking account information upfront, it prevents common errors and improves reliability.

Error prevention

Spot and resolve mismatches before funds are released.

Process reliability

Reduce rejections and delays through early validation.

Payment certainty

Enhance the accuracy and trustworthiness of your international transfers.

More time, same day

Submit international payments in US Dollar (USD), Euro (EUR), and British Pound (GBP) until 20:30hrs and still benefit from same-day value. Flexibility without compromising on speed.

Same-day execution

Transactions sent before 20:30hrs are processed that day.

Optimised banking

Secure digital services designed to support your operations.

Extra flexibility

Later cut-off times give you more room to plan.

Simplify batch payments

Handle high-volume payments more effectively with the ability to approve up to 10 batches (bulk payment or direct debit files) at once.

Time-saving

Approve multiple batches in a single action.

Simplified workflow

Manage bulk transactions with less manual effort.

Operational ease

Boost productivity with faster approvals.

Turning expertise into actionable insights

Internet Banking Pro now supports additional currencies, giving you greater reach in your cross-border operations: Egyptian Pound (EGP), Nigerian Naira (NGN), Malawian Kwacha (MWK), Ugandan Shilling (UGX), Ghanaian Cedi (GHS), West African CFA Franc (XOF), and Norwegian Krone (NOK).

Expanded flexibility

Access a wider range of markets with digital transactions.

Effortless global payments

Transact directly in new currencies without manual processing.

Global growth

Support international expansion with broader currency options.

Your key to security

Security is the backbone of Internet Banking Pro. Your transactions are protected with state-of-the-art security measures. Internet Banking Pro offers encrypted connections, comprehensive audit logs, and in-band/out-of-band transaction signing to safeguard your business.

In-Band and Out-of-Band Signing

Every transaction is secured with dual signing methods, ensuring integrity and protection.

Brute-Force Detection & Account Lockout

Automatic detection and lockout mechanisms defend your credentials against unauthorized access.

Encrypted Connections

Communications are secured using HTTPS with the latest TLS protocols, keeping your data safe from interception.

PCI-DSS Compliance

Sensitive information, including card details and passwords, is never stored in full, ensuring compliance with the Payment Card Industry Data Security Standard.

Comprehensive Audit Logs

Full transparency is maintained with detailed logs of every transaction, available for review and compliance purposes.

Independent Security Audit

Internet Banking Pro has undergone rigorous auditing by a renowned third-party security firm, verifying the strength of our security measures

Session Validity Timeout

Sessions are automatically timed out after inactivity, preventing unauthorized access through impersonation.

CSRF Protection

Your data is safeguarded against cross-site request forgery attacks, further securing your online banking experience.

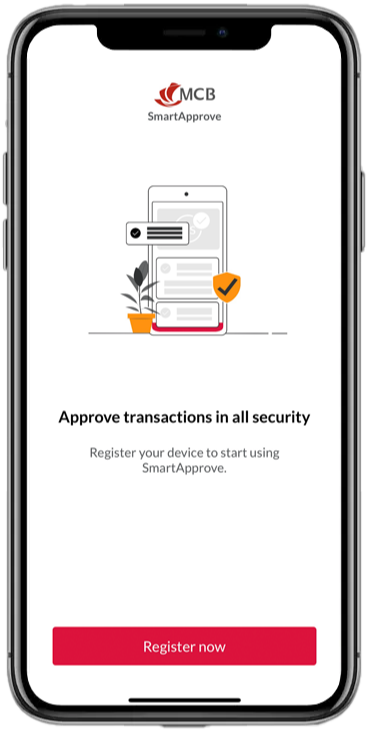

SmartApprove Integration

Approve transactions quickly and securely from your mobile device. With SmartApprove, you can enjoy real-time approvals with biometric security and instant notifications, making financial management easier than ever.

Download